Looking to build an annual passive income from ASX shares?

You're not alone.

Below we look at two leading S&P/ASX 200 Index (ASX: XJO) energy stocks I'd target today for $4,000 a year in passive income.

Both stocks have been paying two fully franked dividends over recent years, which should see me holding on to more of that welcome cash come tax time.

Both stocks also offer market-beating yields, which I believe will continue into 2024 and beyond.

However, please be aware that the yields you generally see quoted, and the ones we discuss below, are trailing yields. Future yields may be higher or lower depending on a range of company-specific and macroeconomic factors.

With that said…

Two top ASX 200 energy shares I'd tap for passive income

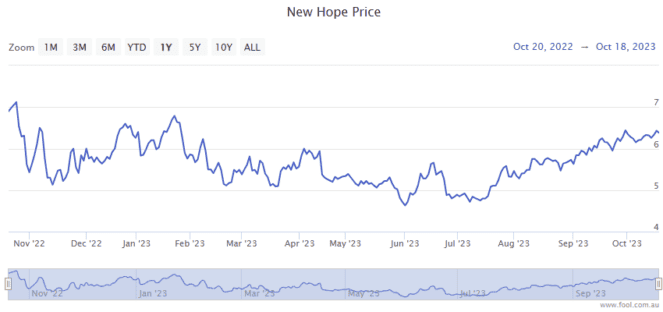

First up, we have ASX 200 coal stock New Hope Corp Ltd (ASX: NHC).

New Hope's dividends have come down in 2023 from the record passive income payouts the coal miner delivered to shareholders in 2022 when coal prices were at all-time highs.

But the dividends remain very attractive. And I agree with the analysts at Liberum Capital in forecasting a continuing uptick in thermal coal prices over the coming months, which should help support the dividend payouts from New Hope in 2024.

Liberum said that with Europe entering winter, power companies on the continent were working to secure ample LNG and coal supplies.

"A conventional northern winter alone will probably test this industry, creating upside price risk for thermal coal, Europe's fuel option of last resort," the analysts said.

Liberum said it was "flagging the northern winter restock as the next likely bullish seasonal demand/price driver" for coal.

As for the most recent passive income payouts, New Hope shares delivered an interim dividend of 40 cents per share on 3 May. The final dividend of 30 cents per share will be paid on 7 November.

That works out to a full-year payout of 70 cents per share. At the current New Hope share price of $6.45, this equates to a fully franked yield of 10.9%.

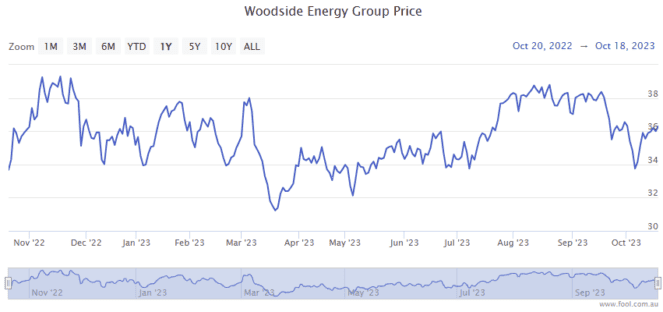

Which brings us to the second ASX 200 energy share I'd buy now for $4,000 a year in passive income. Namely ASX 200 oil and gas stock Woodside Energy Group Ltd (ASX: WDS).

Woodside's dividends have soared in 2022 and 2023 amid strong oil and gas prices. And I believe those prices are likely to remain elevated in 2024, supporting future dividend payments.

Brent crude oil, for example, is trading back at US$93.17 per barrel, according to data from Bloomberg. That's up from US$84.58 per barrel on 6 October, just before Hamas attacked Israel. With Russia's war in Ukraine ongoing and the conflict in the Middle East threatening to expand, I believe the oil price is more likely to rise than fall from current levels.

As for the passive income Woodside has delivered over the past 12 months, the ASX 200 energy share paid a final dividend of $2.154 per share on five April. The interim dividend of $1.243 per share was paid on 28 September.

That equates to right about $3.40 per share for the full year. At the current Woodside share price of $36.40, this ASX 200 energy share trades at a fully franked yield of 9.4%.

Crunching the numbers

So, how much would I need to invest today for a $4,000 annual passive income from these two ASX 200 energy shares?

Assuming I invest the same amount in each stock, I'd earn an average yield of 10.15%.

Meaning I'd need to invest $39,409 today for that $4,000 yearly passive income.

Now, that's a sizeable amount to invest at a single go. But that's okay.

Investing is a long game.

I could also invest in smaller amounts, say $1,000 per month, and I'll reach my passive income goal in good time.