The investment team at WAM Leaders Ltd (ASX: WLE) has picked out an S&P/ASX 200 Index (ASX: XJO) share it thinks is a good opportunity to buy. That business is the packaging company Orora Ltd (ASX: ORA).

Orora provides beverage cans and glass packaging in Australia and New Zealand and "total packaging solutions" including corrugated sheet manufacturing and packaging material distribution in the United States, Canada and Mexico.

WAM Leaders has a proven track record of picking stocks, with a gross performance that has averaged 12.9% per annum since its inception in May 2016. The S&P/ASX 200 Accumulation Index (ASX: XJOA) has delivered an average return per annum of 8% over that same time period.

Why does the fund manager like the ASX 200 share?

WAM highlighted Orora's recently announced acquisition of Saverglass SAS based in France, which it described as a "global leader in high-end bottle manufacturing for premium spirits and wines".

The acquisition was a huge deal for the company. It was valued at $2.16 billion and funded primarily through capital raising and debt.

Wilson Asset Management noted the deal was a surprise to the market "given the size, geography and product diversification", and the Orora share price has slumped 20% since the announcement.

The fund manager suggested the market may need some time to "digest" this transformation because of its scale. However, the investment team saw "significant potential" in the acquisition, and that's why WAM Leaders has increased its position in Orora shares. The WAM team said:

We believe the acquisition provides Orora with a global footprint in the premium spirits and wines market, which is one of the most resilient and fastest growing categories in liquor, supported by the strong market niche with high barriers to entry and low customer churn.

We anticipate this strategic alignment to yield both cost efficiencies and revenue synergies leveraging Orora's existing operations and customer base, ultimately enhancing the long-term value of the company.

Orora itself said that Saverglass would become the centrepiece of its global glass business. It would operate as a third platform for growth under the leadership of Orora and Saverglass' highly experienced management teams, who will remain with the business.

The acquisition is expected to add to the ASX 200 share's earnings per share (EPS) in the mid-single-digits (including full run-rate synergies) in the first full financial year of ownership.

Completion of the acquisition is expected to occur in the last quarter of the 2023 calendar year. Orora said it would continue to update shareholders and the market as the transaction progressed.

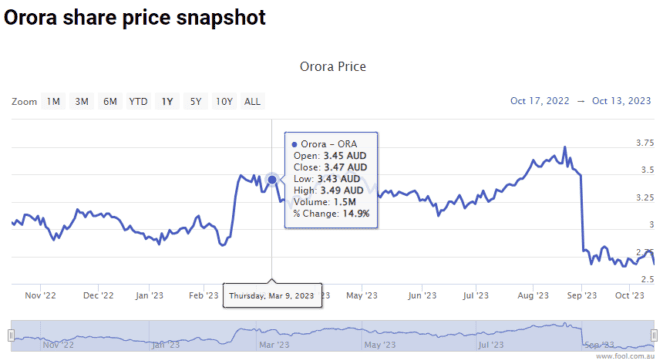

Orora share price snapshot

The ASX 200 share is down around 20% over the last six months and is trading around 10% lower than it was 12 months ago.