ASX lithium shares have experienced volatile trading this year due to large fluctuations in lithium commodity prices and the macroeconomics at play in China.

As reported in The Australian, top broker Citi has just upgraded the following three ASX lithium shares.

Let's take a look.

Citi re-rates 3 ASX lithium shares

Core Lithium Ltd (ASX: CXO)

The Core Lithium share price is up 1.89% to 38 cents at the time of writing on Thursday. Citi has raised its rating on the ASX lithium share to neutral with a 12-month price target of 38 cents.

IGO Ltd (ASX: IGO)

The IGO share price is 0.13% lower at $11.45. Citi has raised its rating on the ASX lithium share to buy and has cut its 12-month price target by 16% to $13.

Pilbara Minerals Ltd (ASX: PLS)

The Pilbara Minerals share price is 0.99% higher at $4.08. Citi has raised its rating on the ASX lithium share to buy with a 12-month price target of $4.50.

What's next for lithium prices?

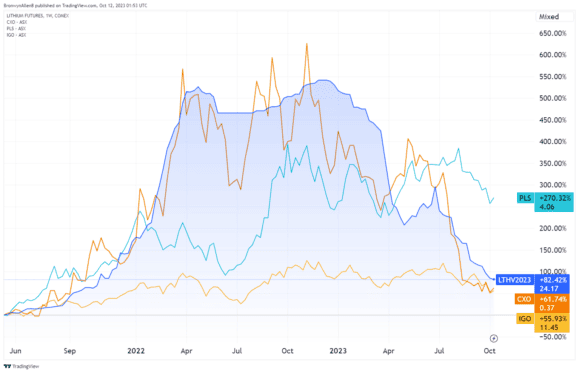

The chart below shows the recent history of lithium futures and the share prices of these three ASX lithium shares above. Not surprisingly, the trajectory of the share price movements somewhat mimics the commodity. This is because commodity prices directly affect revenues (and dividends).

Citi thinks lithium prices could fall another 15% to 20% before a strong long-term rebound.

The broker's short-term forecast is for the lithium carbonate price to fall to US$18,000 and the CME hydroxide price to fall to $22,000 per tonne over the next year. Its long-term forecast for lithium carbonate is US$20,000 per tonne, and for lithium hydroxide, it's US$23,000 per tonne.

The current subdued Chinese economy has direct implications for Australian lithium exports, given it is our biggest customer. About 98% of the spodumene we dug up in 2022-23 was exported to China.

Analysis from Trading Economics discusses the current situation in China, as it pertains to lithium prices:

The concerning macroeconomic backdrop for the Chinese economy also translated to low consumer spending for electric automobiles, driving 10 Chinese new-energy vehicle producers to offer price cuts to reduce the supply glut.

Consequently, lower input demand resulted in a 10% reduction in battery prices in August, according to key market players.

Additionally, further demand concerns emerged after the EU launched an investigation on predatory pricing for Chinese vehicles due to Beijing's subsidies, risking tariffs and trade barriers.

Australia represents 50% of global lithium extraction, and we did a record $20 billion in lithium exports in 2022-23. The federal resources department expects our revenue to decrease in 2024-25 to $16 billion, despite an anticipated lift in export volumes due to lower lithium prices caused by surplus supply.

In the department's latest quarterly report and outlook, it said:

Australian lithium mine production continues growing due to expansions and new mines. Australia accounts for half of global lithium extraction and rising production meets growing global battery demand for lithium.

Australia also has an emerging lithium refining industry. So, instead of shipping our spodumene and carbonate off to other countries to be refined into lithium hydroxide, we'll do the refining ourselves.

Hydroxide is the preferred chemical form of lithium used in electric vehicle (EV) batteries. Global consultancy McKinsey says downstream processing could be worth an extra US$10 billion to the Australian economy. McKinsey says demand for hydroxide will overtake carbonate from 2026.

The department's report notes:

Australia is developing capacity to refine lithium domestically, with three lithium hydroxide refineries (operating or under construction) and a newly announced lithium phosphate refinery. This contributes to the diversifying global lithium refining and developing Australia's battery value chain.

To learn which ASX lithium share listed above already has a lithium hydroxide plant in operation, click here.