Inflation is raging, bond yields are rising to dizzying heights and trouble in the Middle East is threatening the oil market.

Sound familiar?

October 1987 lives in infamy in older investors' minds.

AMP Ltd (ASX: AMP) chief economist Dr Shane Oliver remembers that market crash well, as it was the fourth year of his career in finance.

"In one day, US shares fell 20% and, the day after, Australian shares fell 25%. From the months just before to the months just after US shares had a total 35% fall and Australian shares had a 50% fall," Oliver said on the AMP blog.

"Some lost their fortune, including an older friend of mine (because he wasn't diversified) who had to come out of retirement."

So does this mean 2023 will become another 1987?

Breathe in

After a terrible 2022, many experts thought ASX shares would have a much better time this year with inflation falling and recession dodged.

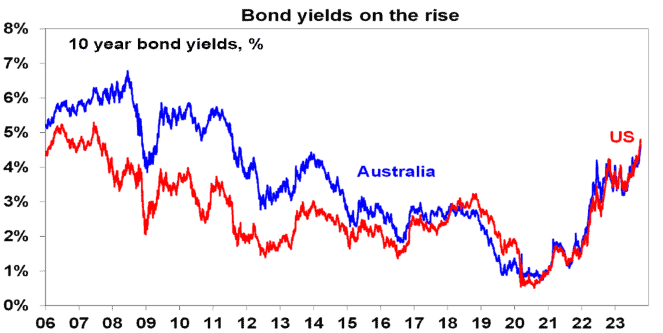

"But the big surprise has been a resumption of the rise in bond yields from April which has taken Australian bond yields to their highest since 2011 and US bond yields to their highest since 2007."

Rising bond yields take money out of the stock market because bonds become more alluring with better returns and lower risk.

To add to this, 2023 has seen one crisis after another:

- Oil prices going through the roof, first because of production cuts by Saudi Arabia and Russia, but now the war in Israel

- China's struggling economy and its real estate sector

- US politics threatening government shutdowns multiple times

- High risk of recession in the US

It's no wonder Oliver reckons "the risk of further weakness remains" for ASX shares.

Now let's go back to 1987.

What were the circumstances that led to that stock market crash?

"The precise causes of the 1987 crash have been subject to much debate.

"But the key driver appears to have been a combination of a 3% rise in US inflation, a 2 percentage point rise in US bond yields and Fed tightening hitting investor confidence at a time when shares were very overvalued after huge gains and investor confidence was unsustainably high."

Uh oh.

Now breathe out

Fortunately, Oliver crunched the numbers and found 2023 has "some big differences compared to 1987".

"Shares have seen far smaller increases compared to the run-up to the 1987 crash — there has been no 1987 style euphoria," he said.

"Forward price-to-earnings (P/E) ratios are higher than in 1987, particularly in the US, but inflation and bond yields are both lower such that the gap between forward earnings yields and bond yields is far more attractive than it was in 1987."

The other assuring factor is that, after the 1987 crash, both US and Australian share markets built in "crash circuit breaker" rules to stop trading after a certain percentage of falls, to allow everyone to chill out.

On a 12-month view, Oliver is convinced shares will be higher than they are now.

"Some things should help shares by year end – seasonality will start to become more positive," he said.

"Inflation is likely to continue to fall which should take pressure off central banks allowing them to start easing next year, and any recession is likely to be mild given the absence of excessive prior spending."

And even if a crash comes, long-term investors have nothing to worry about.

"As it turned out, the 1987 crash seemed to get forgotten about pretty quickly in 1988."

"The US, global and Australian economies did well with little impact from the share crash. And October 1987 now just looks like a blip in long term share prices. For many it was a great buying opportunity!"