Fear continued to grip Wall Street last night, sending all of the United States' major indices backwards. The Dow Jones Industrial Average — an index tracking 30 of the most prominent listed companies in the US — fell 1.29% to 33,003.38 points as fear grew among investors.

Some of the hardest-hit companies within the index included Goldman Sachs Group Inc (NYSE: GS) and Microsoft Corp (NASDAQ: MSFT), declining 3.9% and 2.6%, respectively. The drop in the Dow brings it back down to levels not seen since May of this year.

It wasn't too long ago the share prices of Microsoft, Nvidia Corp (NASDAQ: NVDA), and many others, were scaling new heights. Those celebrations have since become far less common.

Why has the mood suddenly changed?

The name's bond… Treasury bond

Yesterday, I discussed how bond yields are booming locally and in the United States.

The main takeaway from that article was that investors are likely being enticed by the near 5% per annum 10-year returns available by providing finance to some of the world's most developed economies. As such, some people are undoubtedly liquidating their shares and buying bonds by the boatload.

Twenty-four hours have since passed, and the yield proposition has grown more attractive — the US 10-year Treasury bond is now yielding 4.846%.

A sweetening of the yield on debt followed stronger-than-expected jobs data overnight. In turn, expectations for further interest rate increases rose. The current yield is around the same level as what was on offer just before the global financial crisis, as shown below.

President at Bianco Research, Jim Bianco, joined CNBC last night to provide his view on bond yields. In the interview, Bianco outlined his thoughts on why bond yields are climbing, stating:

I don't think we're near the end of this move in the bond market. The more the Fed talks about being done, waiting [and] assessing all the rate hikes they've done, the more they're making it worse.

Furthermore, Bianco noted he thinks yields could surpass 5% within the coming weeks.

As the case for additional rate increases mounts, investors are growing more uneasy about the share market. The fear and greed index provides clear evidence of this, reaching the highest level of fear in nearly 12 months.

Why I wouldn't bet against the Dow Jones

It is a gloomy picture that is being painted by many. However, it can be helpful to a long-term investor to zoom out before being consumed by the temporary fear.

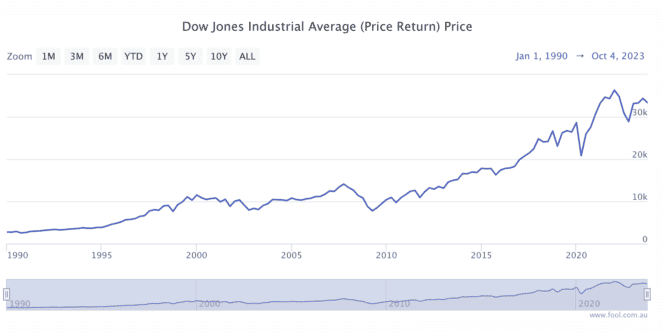

The Dow Jones has been through the rough and tumble of recessions and bubbles before. During the GFC, the index plummeted approximately 53% from its '07 highs before finding its feet.

It sounds horrifying… if an investor cashed out.

However, if someone maintained a cool head — and kept dollar-cost averaging through it all — they would have relished in the near 400% increase in the Dow Jones Index since.