If you own shares in A2 Milk Company Ltd (ASX: A2M), chances are you didn't have a fun time watching your brokerage account over the month of September.

During the month just gone, A2 Milk shares had a shocker, no way around it. The ASX dairy producer started September out at $4.55, after falling nearly 11% over August. By the end of last week, A2 Milk shares had closed at just $4.24 each.

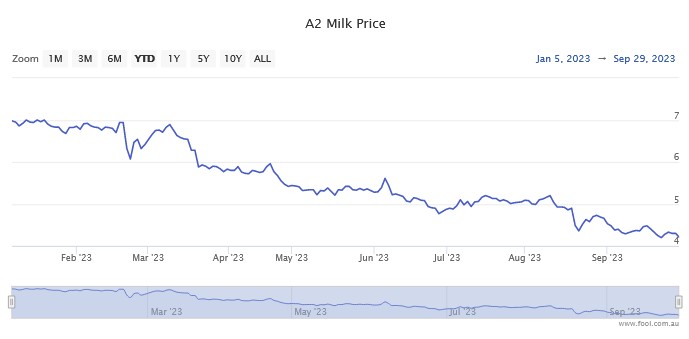

That means that this embattled company lost another 6.8% over the month of September, as well as a disappointing 37.4% over 2023 to date. Ouch.

You can check all of that out below:

There's little doubt that investors lost a lot of confidence in the A2 Milk share price following the company's August full-year earnings.

As we covered at the time, these results showed A2 Milk report healthy numbers for the 2023 financial year. The company revealed a 10.1% rise in revenues to NZ$1.59 billion. As well as an 11.8% rise in earnings before interest, tax, depreciation, and amortisation (EBITDA) to NZ$219.3 million.

That enabled A2 Milk to report a 26.9% surge in net profits after tax (NPAT) to NZ$155.6 million.

However, investors were not impressed, sending the A2 Milk share price down more than 13% on the day these earnings came out. As my Fool colleague James noted then, this was probably due to A2 Milk's weaker-than-expected guidance for the 2024 financial year.

The company told investors to expect "low single-digit revenue growth and an EBITDA margin broadly in line with FY 2023" over the current financial year.

So this is where we stand today after a horror few months for A2 Milk shares. So what might October and beyond hold for this embattled company?

What does the future hold for the A2 Milk share price?

Well, it's hard (and arguably foolish) to make one-month share price predictions for any company.

But what we can report is that one ASX broker in Goldman Sachs isn't expecting any miracles. As we discussed last month after these earnings were released, Goldman reaffirmed a sell rating on A2 Milk shares.

The broker also awarded the company a 12-month share price target of $4.20. If realised, that would essentially see A2 Milk shares tread water over the coming year, given the shares are trading at $4.26 right now.

Justifying its pessimism, Goldman noted that "we expect A2M to still be dragged by underwhelming demand in China and lower child births".

However, it's not all bad news for A2 Milk shareholders. Fellow broker Morgans took a decidedly more upbeat view of the company in the wake of its earnings.

Morgans gave A2 Milk shares an add rating, along with its own share price target of $5.40. It commented that "while near term earnings uncertainty exists, we believe that decent growth should resume in FY25 and FY26".

No doubt shareholders will be hoping that its Morgans that is on the money here on the A2 Milk share price, not Goldman Sachs. But we'll have to wait and see what happens.