The S&P/ASX 200 Index (ASX: XJO) is down 0.28% to 7,018.5 points in afternoon trade following a slump on Wall Street last night. Part of the burdensome weight on the share market's shoulders is the rising yield on bonds.

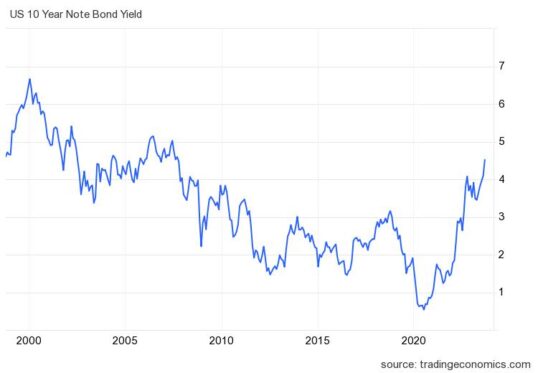

Overnight, the yield from United States 10-year Treasury bonds (a form of government-issued debt) surpassed 4.5%. The figure may not be too eye-catching in isolation. However, it represents the highest yield the bond has offered since 2007 — not long before the global financial crisis (pictured in the chart below).

The rising bond yields follow commentary from the chair of the Federal Reserve, Jerome Powell. In a recent speech, Powell suggested interest rates may need to increase further still to rein in inflation. Or, at the very least, remain elevated for longer.

High bond yields crash the share market party

Rising yields on government debt might be taking the wind out of the share market's sails… but why?

In investing, there are vast options available for allocating our hard-earned cash to generate a return. Prior to the sudden COVID-induced burst of inflation, interest rates bopped around like an anchor at the bottom of the sea floor, holding back meaningful returns on cash or bonds.

Because of this phenomenon, investors lived in a world that unanimously proclaimed 'there is no alternative' — or TINA — to the stock market for achieving an acceptable return.

Now, interest rates are back to levels that are much more palatable, as central banks attempt to curb inflation. As such, investors are more inclined to park a larger portion of their wealth in bonds than in the share market, as bond yields close the gap on average long-term returns from stocks.

The bond market is also pricing in the chance of an additional interest rate increase. With that in mind, two other factors might be weighing down the Australian share market:

- Higher rates would hurt consumer spending, and

- Debt/funding could get more expensive for companies

If funding dries up due to attractive bond yields, it could jeopardise the solvency of some listed companies. According to S&P Capital IQ, nearly 33% of companies on the Australian Securities Exchange did not generate any revenue over the last 12 months — indicating a sole reliance on outside capital.

Why I'm not selling out of shares

Despite the bleak picture this might paint, I'm sticking with keeping the majority of my wealth in shares.

Bonds may well provide a decent return for a time. However, time has proven that the long-term returns from high-quality companies are superior. As such, my holdings in companies such as Jumbo Interactive Ltd (ASX: JIN), Pro Medicus Ltd (ASX: PME), and Apple Inc (NASDAQ: AAPL) — along with the rest of my portfolio — will remain.

If the economy weakens, I plan on increasing my positions in good companies at even more favourable prices.