The Bendigo and Adelaide Bank Ltd (ASX: BEN) share price is up 0.73% to $8.925 amid news it is selling its superannuation business to Australian asset management group BetaShares.

The sale marks BetaShares' entry into the Australian superannuation industry.

Bendigo Superannuation Pty Limited (BSPL) currently has $1.4 billion of retirement funds under administration.

The fund has more than 19,000 members.

Bendigo Bank share price goes green amid super sale

In a statement today, Richard Fennell from Bendigo Bank said the decision to sell the super business was "in line with the Bank's strategic imperative of reducing complexity".

BetaShares CEO Alex Vynokur said superannuation was "a natural next step in our expansion strategy".

Vynokur said BetaShares had been exploring opportunities to enter the super industry for a while and it has "a long-term plan to build our investment in superannuation".

He said BetaShares would expand the existing investment options for Bendigo Bank super members, along with additional financial education tools.

He said:

These initiatives plus a focus on significantly growing the Fund's scale are all aimed at delivering enhanced member outcomes over the longer term.

The sale of BSPL is subject to regulatory approvals and conditions. Completion is expected next year.

BetaShares is well-known to ASX shares investors due to its range of exchange-traded funds (ETFs) and managed funds.

We recently revealed that a BetaShares fund was the top-performing Australian shares ETF for total returns over the past three financial years.

Share price snapshot

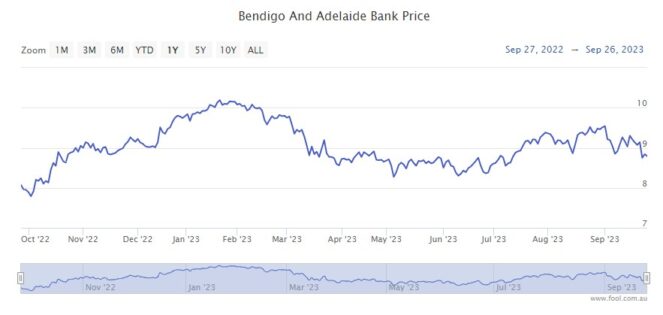

The Bendigo Bank share price has fallen 6.75% over the year to date.

The ASX 200 bank share is up 11.15% over the past 12 months.