The Fortescue Metals Group Ltd (ASX: FMG) share price is in the red today.

Shares in the S&P/ASX 200 Index (ASX: XJO) mining stock closed Friday at $20.81. In early afternoon trade on Monday, shares are swapping hands for $20.51 apiece, down 1.42%.

For some context, the ASX 200 is down 0.29% at this same time.

That's today's price action for you.

Now, here's why the Fortescue share price could be enjoying some ongoing tailwinds over the months ahead.

What's happening in China?

As the world's biggest steel producer, the Middle Kingdom has a voracious appetite for iron ore. And some 70% of that iron ore comes from Australia.

Hence, investors have been keeping a close eye on China's struggling property sector. And on the government's slow drip feed of stimulus to spur more activity in the sector.

That stimulus has partly been responsible for helping keep the iron ore price significantly higher than most analysts have been forecasting, benefiting the Fortescue share price.

The industrial metal is currently trading for $US$120.95 per tonne. That's up more than 16% since 16 August.

But Chinese steel mills' demand for iron ore goes well beyond the property sector. Atop the nation's massive infrastructure projects, there is growing steel demand from China's booming EV industry.

Commenting on China's steel demand, Fortescue Metals' former business development head in China Bin Jung Zhuang said (courtesy of The Australian Financial Review):

China is still the world manufacturing centre, massive expansion of EV production in China for both domestic and export markets, massive expansion of green energy plus continuing domestic infrastructure. All these require steel.

Although steel capacity has plateaued, the demand for steel and therefore for our iron ore is still strong despite the soft property market.

Indeed, China became the world's largest car exporter in the first quarter of 2023, according to MEPS International, shipping 1.07 million vehicles.

And in the first four months of 2023, China exported 1.37 million vehicles.

To give you some idea of the growth that could help support the Fortescue share price, April alone saw 376,000 vehicles shipped, up 170% year on year.

China's largest EV manufacturer BYD is among the companies launching new product ranges in Europe.

Still, most analysts are forecasting the iron ore price to slide from today's levels.

Lead mining and energy commodities strategist at Commonwealth Bank of Australia (ASX: CBA) Vivek Dhar expects the iron ore price will be around US$100 per tonne by the end of 2023.

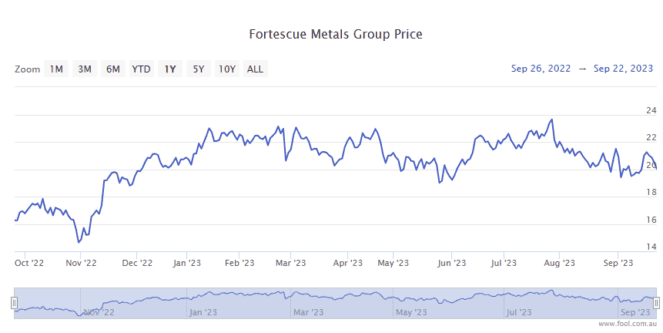

Fortescue share price snapshot

The Fortescue share price has been a strong performer over the past full year.

Twelve months ago, the iron ore price was right about US$100 per tonne. Fortescue shares have gained 29% since then.