Do you think people of certain ages do better than others in investing in ASX shares?

Older folks would tell you life experience is crucial to understanding the world and how people think, which all helps stock selection.

Younger investors might say that they are more open to new technologies and innovators, which bring the best returns in the longer run.

Well fintech Openmarkets set out to finally settle the debate.

The company analysed 100,000 trading accounts to break down the ASX portfolio performance by baby boomers, generation X, Y, and Z.

Let's check out what happened over the 2023 financial year:

And the winner is…

Perhaps against stereotypes, during a pretty volatile time in the market, young investors won out against their older counterparts.

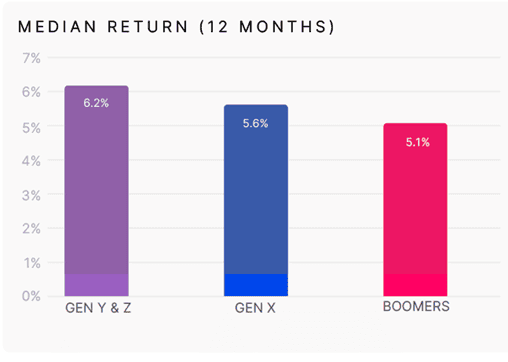

Generation Y and Z portfolios returned a median of 6.15% over the 12 months ending 30 June, while generation X saw 5.6% and baby boomers raked in 5.06%.

How did they do it?

Openmarkets chief Dan Jowett reckons the later generations used a two-pronged approach in their ASX portfolio to achieve the superior returns.

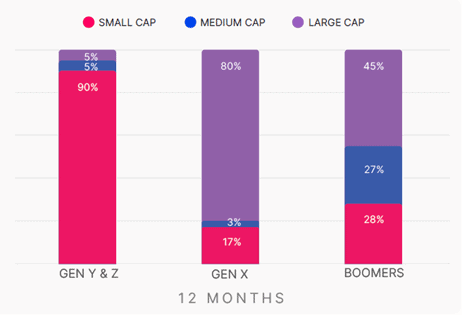

"Younger Australians have achieved higher returns by balancing exposure to small-cap growth stocks with larger low-risk assets like banks and listed investment companies (LICs) to manage overall risk," he said.

"We are pleased to see this younger cohort taking a balanced approach."

The unfashionable becomes fashionable again

During the 2010s, exchange-traded funds (ETFs) exploded in popularity at the expense of LICs, which were seen as outdated and inflexible.

But that all seems to have changed since the growth stock downturn last year.

"Listed investment companies have returned to popularity in the past 12 months, with many younger investors taking advantage of low LIC share prices, many of which have recently traded at a discount to asset book value."

Surprisingly, the typical portfolio doesn't seem to be sufficiently diversified.

The average portfolio of baby boomers holds 6.9 stocks, generation X has 4.7 stocks, and generation Y and Z own 4.4 stocks.

That's not very many for each investor, although if they're holding LICs or ETFs then diversification is built-in.