The Australian share market is glowing green in afternoon trading. However, one ASX 300 stock is having a day to forget today.

While 175 companies included in the S&P/ASX 300 Index (ASX: XKO) are experiencing higher share prices on another busy day of reporting season, one listed company is trailing far behind.

This downtrodden constituent is being punished after sharing its full-year results for FY23 with investors this morning.

Which ASX 300 stock is sinking?

Claiming the wooden spoon for worst-performing ASX 300 company today is Brisbane-based IT services and solutions provider Data#3 Limited (ASX: DTL).

Investors are looking for the exit on Tuesday, with more than two million shares changing hands — more than four times the number traded yesterday. So, what did the company report to create such a panic?

Let's take a look:

- Revenue up 16.9% to $2.5 billion

- Net profit after tax (NPAT) up 22.4% to $37 million

- Basic earnings per share (EPS) up 22.2% to 23.96 cents per share

- Fully franked dividend of 21.9 cents per share, increasing 22.3% from the prior year

- Cash and cash equivalents of $404.8 million, up from $149.5 million

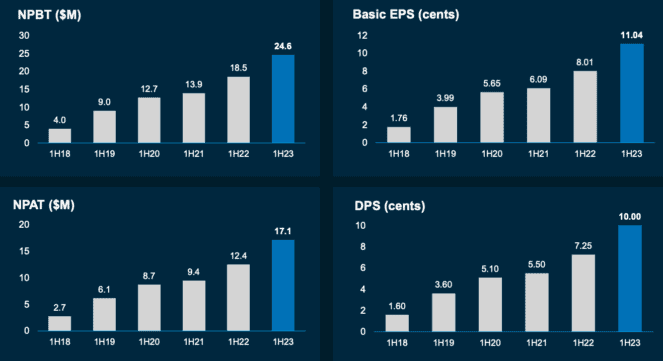

Looking at the above, it's difficult to understand why the market has reacted negatively to the result. Not only have most key fundamentals grown since last year, but they have also trended in this direction for several halves now, as shown below.

Two possible negatives from today's figures could include:

- Gross margin slipped from 10% to 9.8%; and

- Interest income constitutes roughly half the increase in net profits

Interest income swelled from $273,000 in FY22 to $3.5 million in FY23 due to higher interest rates. This would suggest the company's earnings from its operations possibly only grew by approximately 11% during the 12 months ending 30 June.

Nevertheless, the extent of the reaction is somewhat of a mystery.

What about the outlook?

Often a poor outlook can be to blame for a steep share price fall if the results are solid. Unfortunately, this ASX 300 stock did not provide specific guidance for FY24, which could be a warning sign.

However, commentary shared by Data#3 CEO Laurence Baynham was largely positive. For example, Baynham said:

We continue to experience a steady increase in the pipeline of large integration project opportunities across our corporate and public sector customers and are seeing strong revenue growth in our high-margin Managed Services and Consulting businesses, complementing our growing Software and Infrastructure business units.

The CEO added:

With our leading market position, strong supplier relationships, long-term customer base and experienced team, we are confident in our outlook as we enter FY24, despite some expected slowdown in general economic activity. The industry is rapidly progressing, and we are well-positioned to benefit.

The Data#3 share price is now mostly flat compared to a year ago due to today's crash. Although, ASX 300 stocks broadly are not too different when looking at the index, which is up a marginal 0.5% over the past year.