The Alcidion Group Ltd (ASX: ALC) share price is on the move today as shareholders digest the company's fourth-quarter performance.

Shares in the healthcare software provider are 9.1% higher this morning, trading hands at 12 cents apiece. More than 4.5 million shares have already been exchanged today, compared to the past month's average one-day volume of approximately 1.2 million shares traded.

The Alcidion share price opened the session at 12.5 cents before edging down a step.

Alcidion share price shines as cash flows explode

Here are the key numbers from Alcidion's fourth-quarter FY23 report:

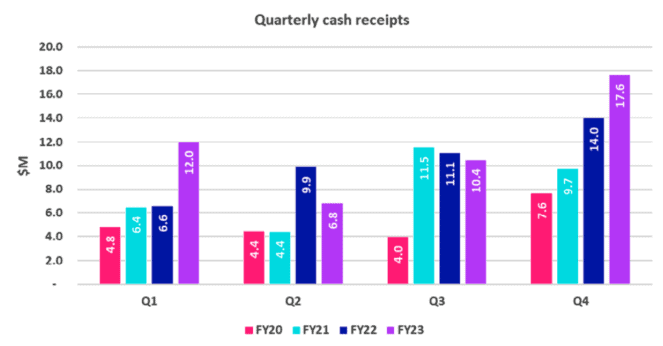

- Record quarterly cash receipts of $17.6 million, up 25.7% on the prior corresponding period

- Positive operating cash flow of $6 million, increasing 81.8%

- New sales of $7.3 million during the quarter

- Cash balance of $14.6 million, up from $11.1 million in the previous quarter

- Contracted and renewal revenue of $33.7 million expected in FY24

The record achievement in cash receipts in the fourth quarter builds upon Alicidion's all-time performance last year. At that time, the company pulled in $14 million to mark a new high for the financial measure.

Ending FY23, Alcidion improved its cash receipts in two out of four quarters during the financial year. The exceptions were Q2 and Q3, which were attributed to timing delays.

What else happened in the fourth quarter?

On 30 May, two existing Patient Care System (PCS) customers — obtained via the Silverlink acquisition — renewed their contracts. Signing a two-year agreement, Royal Wolverhampton NHS Trust is now on board for additional two years, expiring in March 2025.

University Hospitals Dorset NHS Foundation Trust also signed a three-year agreement with the Silverlink PCS solution. The renewal extends the partnership to March 2026.

Despite representing $3.3 million in combined value, the Alcidion share price failed to respond positively on the announcement day.

The final earnout payment to Silverlink has been made after the renewal. The A$2.7 million payout was funded by existing cash reserves from its balance sheet.

What did management say?

In light of the record quarter, Alcidion managing director Kate Quirke stated:

In Q4, we enjoyed module sales to both new and existing customers. Additionally, there were several contracts signed with existing customers for ongoing service delivery. The combination of these sales demonstrates the resilience of our business and the commercial value being delivered on a long-term and sustainable basis.

Adding to this, Quirke highlighted a recent success story following the implementation of Alcidion's solutions:

With a purpose to free clinician time to provide care, it is rewarding to receive feedback from customers who say their doctors have realised savings of at least one hour per day in reduced administrative burden since implementing our software, as was recently relayed by South Tees Hospital NHS Foundation Trust.

What's next?

Alicidion management is already eyeing down where the avenues of growth are ahead. The team believes they are particularly well positioned in the United Kingdom to take advantage of new contract opportunities.

In terms of the next year, Quirke said, "I am confident in our ability to continue delivering accelerated growth as we capitalise on global market tailwinds."

Notably, Alicidion has formed a strategic partnership with Olinqua — a market leader in hospital automation — to roll out Miya Central. This product will specifically target improving operational efficiency and making data-driven decisions.

Alcidion share price snapshot

The Alcidion share price has been in the doghouse in 2023, falling 20% year-to-date.

Perhaps the lack of bottom-line earnings has left investors uninterested in this ASX company. Generally, the small-caps have struggled more than their larger peers this year as shareholders seek out safety in the stalwarts of the market.

For example, the S&P/ASX Small Ordinaries Index (ASX: XSO) is up 5% in 2023. Whereas the S&P/ASX 200 Index (ASX: XJO), containing more established companies, is up 7.3%.

The current Alcidion share price gives the company a price-to-sales (P/S) ratio of 3.6 times sales.