Since listing in 1994, CSL Limited (ASX: CSL) shares have showered their shareholders with life-changing returns.

Over the past ten and five years, the herculean healthcare company has decimated the S&P/ASX 200 Index (ASX: XJO), administering 309.5% and 29.3% returns. The Australian benchmark served up a 44.7% and a 14.8% gain over the two respective periods.

It's fair to say the biotech company has proven to be a high-quality investment in the past.

However, the past year has seen CSL outshined by the broad basket of Aussie equities. Following a revised earnings guidance, a steep fall in June has drastically impacted the company's year-long performance — now underperforming the ASX 200 by 18.5%.

Will it be temporary, or are we seeing the beginnings of a long-term trend in CSL shares?

A pipeline full of potential

Writing CSL off as a 107-year-old dog with no new tricks left to learn might be tempting.

Aside from the recent Vifor acquisition, the company has primarily been a plasma-based product and vaccine developer for as long as anyone can remember. The addition of Vifor expands the business into kidney disease treatments.

However, the core CSL Bering and Seqirus segments should not be understated. Behring — the plasma therapies division — has established a toolbelt, of sorts, for blood-based treatments and rare diseases. Products span from medication for Rh incompatibility to common coagulants.

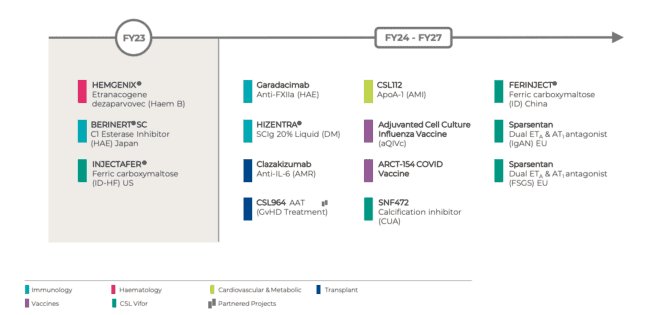

As it stands, CSL's portfolio of products is vast and impressive. Although, the breadth of the company's research and development (R&D) pipeline (depicted below) is the primary source of excitement for the future of CSL shares.

In my view, CSL won't be able to rest on its laurels to succeed as a market-beating investment in the future. Fortunately, there are currently no signs that this will be the case.

For example, Garadacimab is in development for treating patients with hereditary angioedema — a potentially life-threatening genetic disorder that affects one in every 50,000 people. In February, CSL announced positive results from its phase 3 trials of Garadacimab.

The Australian company has the advantage of its R&D efforts being well-funded by its relatively stable and predictable earnings base.

There's always a chance this could be disrupted. However, CSL benefits from one of the largest plasma collection networks in the world — keeping a moat around its core operations.

Law of large numbers

On the flip side, CSL shares are not without their risks.

The law of large numbers is a key reason why the company may fail to outperform the market. It becomes harder to grow at the same high rate as the dollar amounts increase. Simply put, it's dead simple to go from $10 to $20 — but try ratcheting up $2.12 billion to $4.24 billion.

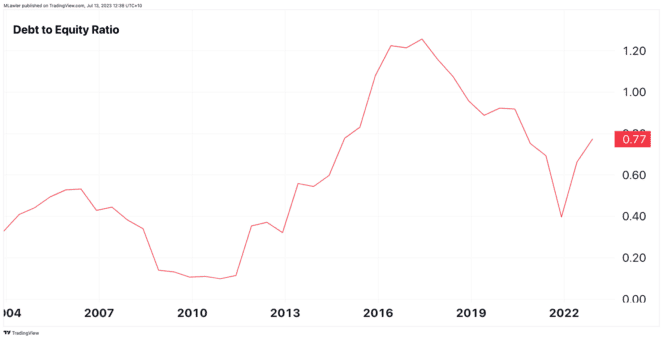

We're already seeing CSL turn to big acquisitions — forking out $18.8 billion to secure Vifor. Leaving CSL's balance sheet with more than $10 billion in net debt.

To be fair, its debt-to-equity ratio is still in better shape now than in prior years, as shown above.

Nevertheless, larger acquisitions present more risks. There's already been a minor blip with Vifor, with its Ferinject — an iron deficiency drug — seeing generic competitors entering the competitive landscape.

Maybe CSL was aware of this during the acquisition, but it is an example of the baggage that can come along with these mega deals.

Foolish final verdict on CSL shares

At around 33 times forward earnings, CSL shares are trading roughly in line with the industry average. Hence, I would consider the $264.48 price fair but not exactly a deal that screams value.

The incredible brand, product portfolio and R&D pipeline give me confidence that CSL shares can still outperform ASX 200 over the long term.

However, I would take a dollar-cost averaging approach to build a position in this company. While it might mean forgoing some dividend income in the near term, it would allow me to take advantage of any weakness in the share price over time.