Uranium is one commodity that's been bounding higher over the past 12 months. The movement has helped Paladin Energy Ltd (ASX: PDN) shares creep ahead over the same period.

The uranium producer has enjoyed a 10.8% boost in its share price in the last year. During this time, Paladin has been working toward restarting its Langer Heinrich mine in Nambia.

The company's large $2.1 billion market capitalisation hinges on Paladin returning to being an operational miner. It's targeting production in the first quarter of 2024.

As the world contends with greater energy demand and decarbonisation, Paladin Energy shares might still have more power left for their shareholders.

Renewables won't be enough

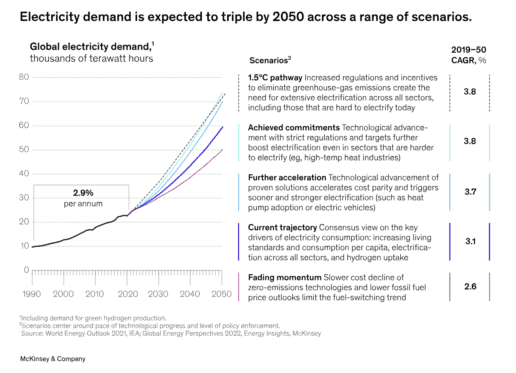

According to research compiled by consulting firm McKinsey, global electricity demand is expected to triple, shown below, by 2050.

McKinsey noted scaling restraints in renewables, including land scarcity, raw materials, and transmission limitations, as factors that would drive the demand for more nuclear power generation.

The firm estimates that nuclear energy will need to supply between 10% to 20% of future global electricity demand. Only then would we meet the anticipated supply for net-zero emissions by 2050. This would suggest a potential doubling or tripling in nuclear power capacity.

The team at Shaw and Partners are on the same page. Providing insights on the uranium outlook, the broker stated:

Nuclear is becoming a more important part of the energy transition as governments face the reality that investment in renewables is not going to meet decarbonisation objectives due to limitations on transmission, batteries and firming capacity.

Paladin Energy shares were also named as the broker's "premium exposure to an expected surge in uranium prices".

Will Paladin Energy shares face dilution?

As of 31 May 2023, Paladin counted US$132 million in cash on its balance sheet. Meanwhile, its strategic placements have reduced the company's debt to zero. That gives the uranium hopeful a healthy stash to fund its restart program.

Paladin's funds should be enough to cover operating expenses with only two more quarters before production is planned to commence. For context, around US$28 million was consumed in the 12 months ending 31 December 2022.