Block Inc CDI (ASX: SQ2) shares have enjoyed a 10% boost in the past month, finishing at $96.64 apiece at yesterday's market close.

But it's a far cry from the payment technology provider's all-time high of $196.00 a share back in March 2022.

Since then, the payments sector has been squeezed by robust competition, rising interest rates and, more recently, the confirmation of new regulations for buy now, pay later players in Australia.

So are Block shares a good buy in the current climate, or has the alternative payments sector had its time in the sun? Below, two Motley Fool writers present the bull and bear cases for Block shares.

Backing Block shares for untapped growth

By Mitchell Lawler: To the disappointment of shareholders, Block shares have underperformed the broader S&P/ASX 200 Index (ASX: XJO) so far in 2023.

If I had to guess, investors have gone cold on Block due to the company's weak earnings profile in a more volatile economic environment. This could potentially be short-sighted given its continual execution of growth.

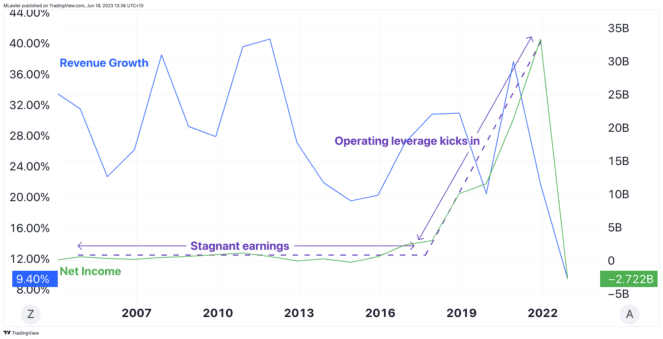

Although Block's bottom line is not a glamorous one, the company's combination of strong revenue growth and underwhelming net profits reminds me of a similar setting many years ago with Amazon.com Inc (NASDAQ: AMZN).

Despite continuously expanding revenue by 20% or more each year, Amazon was often written off by investors for lacking meaningful earnings growth for nearly a decade. Then, suddenly, the earnings engine was flipped on, as shown above.

More markets still to disrupt

At roughly US$18.6 billion in revenue for Block for the past 12-month period, it's easy to assume the company is nearing maturation. Though, I would argue there are still plenty of data points to suggest the days of 20% to 25% year-on-year revenue growth are far from over.

In terms of the Square ecosystem (the merchant side), Block has barely scratched the surface of the mid-market segment – the next tier up from small and mid-sized businesses – at only 0.5% penetration. Likewise, there is still plenty of room for growth in SMBs, with only 4% of the market already tapped into Square.

The other growth driver worth considering is Block's entry into new geographies with its Cash App (consumer side) product. In its latest investor presentation, the company is already targeting an eventual launch in Australia.

Are investors underestimating future profitability?

When it comes to valuation, Block's AUD$60 billion market capitalisation might look expensive based on its current lack of net profits. However, I believe this company could eventually be worth in the range of US$150 billion to US$190 billion in the next five years.

This estimate is based on the belief that Block can achieve net margins in the realm of 15%. Given that the company's offerings are mostly software/app based, I expect the company to benefit from attractive unit economics as it onboards more customers.

Hence, I think Block could surprise the market by flipping the profit switch in the future, much like Amazon did.

Valuation is blocking my excitement

By Tristan Harrison: Block is an impressive business with a global presence, but I don't think it has the same outlook as it once did.

For starters, global growth is slowing down, according to various sources, including the World Bank. Usually, it makes sense for investors to look through global economic troubles but, as a payments processor, Block's finances are linked to the strength of the economies it operates in.

Indeed, the company's growth rate seems to be slowing. Gross profit growth in the first quarter of 2023 was 32%. That's lower than the 38% growth in the 2022 third quarter and 40% growth in the fourth quarter of 2022.

In April 2023, gross profit growth was 24%. The latest figure showed the slowest growth so far. How much should a business be worth if its growth rate is slowing and (at this stage) it's still making statutory losses?

Block is valued at tens of billions of dollars. However, there's a lot of competition in the payments space, including from the likes of Apple. Certainly, competition from a global giant could hamper growth and possibly lower margins.

Another negative is that its debt is going to become more expensive as interest rate rises flow through over time. Block had US$4.1 billion of long-term debt as at 31 March 2023.

Another area that could limit Block's growth is that the BNPL sector is now facing increased regulation in Australia. Indeed, its products will be treated as credit with the same checks and balances required.

For me, there are other ASX growth shares that look better priced for how much growth they may be able to deliver. If we look at the chart below, the ratio for Block's enterprise value to earnings before interest, tax, depreciation and amortisation (EBITDA) has come down, but it's still high.