Appen Ltd (ASX: APX) shares might still be a long way off their glory days, but that doesn't change how fruitful they've been in 2023.

Rising up from the ashes, the machine learning and artificial intelligence (AI) company is up a cracking 30.5% so far this year. To put it into perspective, the S&P/ASX 200 Index (ASX: XJO) has only managed a 2.7% return during this time.

In light of the AI mania, we asked two of our writers to provide a few reasons why Appen shares might, and might not, be a buy today.

A high-risk and potentially high-reward tech share

By Bernd Struben:

Appen shares have been riding high in the wake of expectation-smashing second-quarter revenue forecasts from AI-focused tech giant Nvidia Corp (NASDAQ: NVDA).

Appen has been working with Nvidia since 2020.

In May the company reported an expansion of their collaboration that will see its data services combined with Nvidia's AI Enterprise platform. Which is the first reason to buy.

From 24 May through to 2 June the Appen share price surged 69%. Investors have been betting that the company will deliver on its mission to improve the data used in AI programs and ride the generative AI boom.

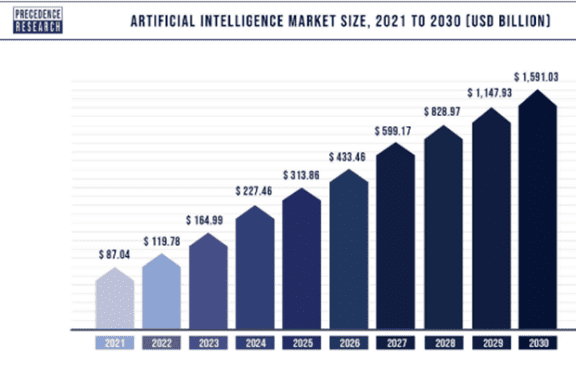

For some idea of the size of that opportunity, Precedence Research forecasts the global AI market will grow from some US$120 billion in 2022 to US$1.6 trillion by 2030. That represents a compound annual growth rate (CAGR) of 38%. Which is the second reason to buy.

Revenue and profits down

Appen's financial trajectory over the past year has been less than stellar.

In a performance update covering January through to the end of April, the company reported a 21% year-on-year slide in revenue and a 25% decline in profits. The company is addressing this with some major cost-cutting initiatives underway.

Why now could be a good time to buy

The poor start to the year has helped bring the Appen share price down to a level where there could be some major upside ahead.

Last week's rather poorly received capital raising, at a steep discount to the prevailing share price, saw shares tumble 14% over the week. That sees the stock down 39% over 12 months.

Still, Appen ended the week with some $60 million in additional working capital. And post that dilutive raise, the tech stock could deliver investors some outsized gains, the third reason to buy.

Make no mistake though.

This is a high-risk, speculative bet.

If Appen's AI products take off, so could its share price. The company could also find itself a potential takeover target.

However, if Appen's AI products aren't superior to ones produced by competitors, shares could head south.

Motley Fool contributor Bernd Struben does not own shares in Appen Ltd or Nvidia Corp.

Plenty of hurdles for Appen shares to overcome

By Mitchell Lawler:

The bulk of the Appen share price rally has played out during the past month. A period in which computer chip giant Nvidia unveiled its eye-popping forward estimates for a spectacular, AI-driven second quarter.

The recent correlation between Appen and Nvidia shares makes me concerned that the ASX-listed company's run is not rooted in fundamentals.

Hard to scale model

Although Appen is often heralded as a 'tech' company, I think this is debatable. While Appen does have some tech attributes, it more closely resembles a consulting business in my view – an industry I worked in for a time.

The pain with running a consulting business is that it doesn't easily scale. Outputs (successful projects) are linked to inputs (number of employees/hours).

If Appen wants to drive greater revenue from more projects with its clients, it will need to contract out more workers – keeping margins tight. This is demonstrated by Appen's net margins capping out around 12% over the past decade.

As long as it continues to rely mostly on real-world data and manual annotation, I tend to think Appen will struggle to compete with its much larger competitor, Telus International (TSE: TIXT).

Synthetic reasons

Appen might be jumping on the generative AI bandwagon, though, in some ways I believe it is still behind the curve. Namely, the use of real data and manual labelling.

In its 2023 investor technology data presentation, the company claims to be more relevant than ever before as large language models require fine-tuning and assurance to solve the alignment problem. However, its answer is the same old, manually intensive input – the Appen crowd.

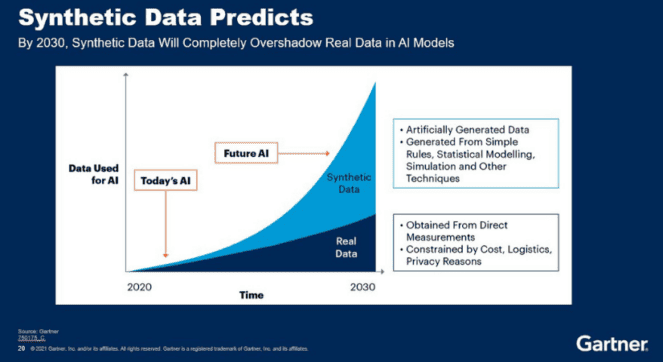

More sophisticated solutions are already available. Most notably, the emergence of synthetic data. This is artificially generated data that does not require labelling, streamlining the creation of training data. This could put more pressure on Appen's ability to compete in the industry if it fails to innovate.

For reference, Gartner — a technology research and consulting firm — forecasts the majority of AI development data will be synthetic by 2030, as shown in the chart above.

Where is the growth?

Finally, it should be a red flag that competitors, such as Telus, have been booming while Appen languishes.

Unlike our local AI player, Telus posted record revenues and solid profits for the 12 months ending 31 March 2023. Evidently, the pain dealt to Appen shareholders is a company-specific catalyst, not an industry-wide one.

If I were to take a guess, I'd say Appen may have relied more heavily on Meta Platforms Inc (NASDAQ: META) than Telus. Possibly the Facebook owner has been doing more work in-house following the 2021 acquisition of synthetic data startup AI Reverie.

Motley Fool contributor Mitchell Lawler owns shares in Meta Platforms Inc.