This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

It's been a rough year for the NASDAQ Composite Index (NASDAQINDEX: ^IXIC), plunging nearly 30% this year. While part of this sell-off was certainly warranted (as 2021's valuations couldn't be sustained), some stocks have sold off too much.

Here are three stocks I'm looking at buying as their long-term opportunities are still intact while their share prices are well off their highs: Alphabet Inc. (NASDAQ: GOOG), MercadoLibre, Inc. (NASDAQ: MELI), and CrowdStrike Holdings, Inc. (NASDAQ: CRWD). Stick around to find out why.

Alphabet

Alphabet (formerly known as Google) is a huge conglomerate of businesses, but its primary focus is advertising. In good times, this business shines. Unfortunately, in bad times, advertising can be a rough business to be in.

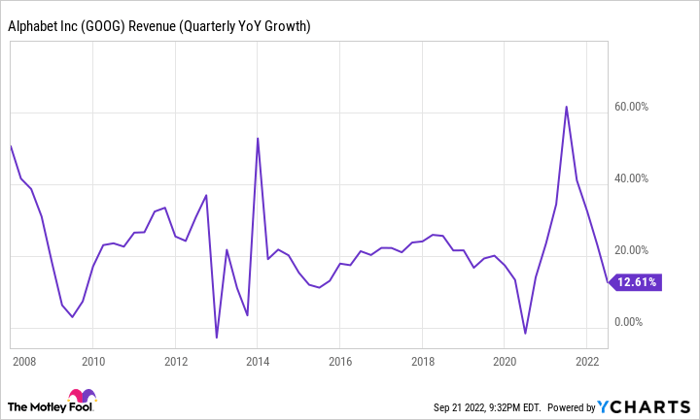

When companies are forced to cut costs to maintain profits, advertising budgets are often the first thing to go. It's an easy cut compared to laying off workers or canceling projects, so many companies do it pre-emptively if they see signs of a slowing economy. This line of thinking harmed Alphabet in the second quarter, but it still managed to grow revenue by 13% year over year.

That resiliency shows how vital it is for businesses to advertise on Alphabet's family of businesses (like the Google search engine, Android operating system, or YouTube).

Despite rising expenses (which caused Alphabet's profitability to drop), Alphabet trades at a historically low 18.6 times earnings. That's dirt cheap for a company whose revenue has always recovered after economic downturns.

GOOG Revenue (Quarterly YoY Growth) data by YCharts.

I'm confident that this slowdown will be like the rest, and Alphabet's revenue growth will recover to higher levels, bringing its strong cash flows higher with it.

MercadoLibre

Another internet powerhouse, MercadoLibre, is based in Latin America. Serving 18 countries -- home to about 650 million people -- MercadoLibre brings many facets of e-commerce that Americans take for granted to Latin America.

With fintech and commerce platforms, consumers can shop on Mercado Libre (the commerce site) and pay with Mercado Pago (its payment platform) while using the credit card they got through Mercado Credito (its credit division). Then, the package may arrive on the customer's doorstep in less than 48 hours after being delivered by Mercado Envios (its logistics division). Nearly 80% of packages it handled were delivered in under 48 hours in Q2.

MercadoLibre is the e-commerce site in Latin America, and for good reason. Backing up its market dominance are its results, which were fantastic in Q2.

Revenue rose 57% year over year to $2.6 billion, driven by strength in fintech, which grew revenue 107% to $1.2 billion. Commerce is facing tougher comparisons (thanks to a COVID-affected 2021 Q2) but still grew revenue by 23% year over year while its gross merchandise volume rose 26%. While not massively profitable, MercadoLibre still posted a 4.7% profit margin in Q2.

With those results, you might expect the stock to be up significantly this year or to at least break even. However, the shares are down 34%, and the valuation sits at five times sales. The last time MercadoLibre was this cheap was at the depth of the Great Recession in 2009.

MercadoLibre has traded around 12 times sales for nearly all of the past decade, so this stock is incredibly cheap. As a result, I believe MercadoLibre is one of the strongest no-brainer buys in the market today.

CrowdStrike

While the first two stocks are cheaply valued, CrowdStrike is not. Instead, it trades for a hefty 21 times sales. Still, I think it's an excellent buy today because of its market opportunity and sustained, strong execution.

CrowdStrike is a cybersecurity company, and with the cost of cyberattacks expected to grow 15% annually through 2025, it's an area that businesses can't afford to cut corners on now. With its cloud-based platform, CrowdStrike's software can quickly deploy to network endpoints (like phones or laptops). Its software uses artificial intelligence and machine learning to evolve the program continuously, so when one customer experiences an attack, the entire customer base's defense is strengthened through that information.

While many companies have slowed their enterprise software spending, CrowdStrike managed to grow its customer base by 51% in Q2 (ended July 31) to 19,686. Among these customers are 69 of the Fortune 100 and 537 of the Global 2000, showing that CrowdStrike still has many customers to capture, especially smaller businesses worldwide.

Annually recurring revenue (ARR) also rapidly increased in Q2, rising 59% year over year to $2.14 billion. Still, this is a drop in the bucket compared to CrowdStrike's projected $126 billion market opportunity in 2025.

While CrowdStrike may be an expensive stock, its massive market opportunity and strong growth are the culprits of this valuation. Unfortunately, the best companies don't often come cheap, so investors sometimes pay a premium to own a specific business. However, if CrowdStrike's growth continues on its strong trajectory (management projects ARR will be $5 billion by January 2026), the price that investors are paying today will seem much cheaper.

The NASDAQ has multiple great investment opportunities available now; investors just need the confidence to step in and buy stocks when everything seems to be looking grim.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.