Key points

- Company earnings are beginning to feed through on the ASX

- We go over four sections of an earnings report and what can be helpful to make a note of

- Consider it a crash course in fundamental investing, hopefully helping avoid a crash in the process

Once again we're saying hello to another ASX earnings season! This is an exciting time when publicly-listed companies release their financial results for the past quarter/half year.

Company reports can be daunting to read, especially if you're not familiar with all the financial jargon. However, they are a valuable source of information for investors, and it's important to know how to digest them.

During ASX earnings season, it's even more important to stay on top of company reports so you can make informed investment decisions.

In this article, we will break down company reports into 4 bite-sized pieces. In the process, we'll explain what each section means and what are some key takeaways to be looking for when reading them.

Taking an earnings report head on

The world of investing is a constant educational journey. Whether you're a seasoned investor or still wet behind the ears, there is always more to learn.

Today, class is in session for a timely topic — how to make sense of earnings reports. To better understand this staple of an investor's research, we'll reference JB Hi-Fi Limited (ASX: JBH) half-year report from last year.

First bite: company's own snapshot

Typically, the first section of an earnings report is reserved for the company to discuss some key highlights from the relevant reporting period. Often this comes with commentary from the chair and/or CEO, relaying any key points of information to shareholders.

This first section can serve as a good base for understanding what the company does; what significant events occurred during the reporting period; and how performance is tracking compared to expectations.

In this section, it can be handy to take note of any challenges or opportunities outlined by the company. Another important segment to pay attention to is the remuneration report within the ASX earnings report (usually in annual reports). It is here where investors can find out how directors are being remunerated, including short and long-term incentives.

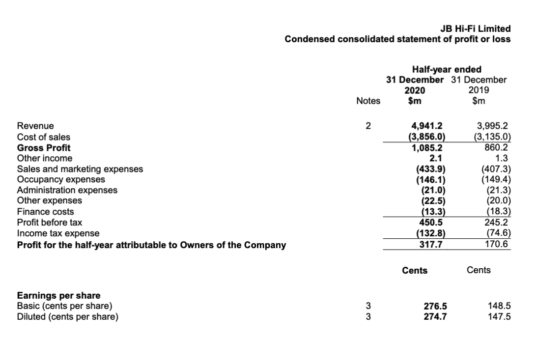

Second bite: income statement

Further into the ASX earnings report is where we will find the company's income statement, also known as the profit and loss statement. Simply put, this is the total money in for the company during the period, minus the total money out.

In JB Hi-Fi's half-year report, as shown above, the revenue figure represents the money that came into the company. When we get to the last line item 'Profit for the half-year attributable to owners of the company' — or otherwise known as net profit after tax — this is the amount of money retained by the business after all expenses are taken out.

Investors should pay attention to any one-off line items and adjustments. Often it is helpful to take note of any significant increases in certain expenses. This will help tell the story of where the company is pouring its money into. For example, in the above JB Hi-Fi example, the biggest increase was in sales and marketing expenses.

Third bite: cash flow statement

Cash flow is an important metric for shareholders and company's to keep a close eye on. In an ASX earnings report, investors can find this under the cash flow statement. Keep in mind, cash flow is different from profit.

This statement gives insight into where the company's cash is coming from and going to. Usually, this is separated into three segments: cash flow from operations; cash flow from investments; and cash flow from financing. Ideally, the company is cash-flow positive, with more money coming in than going out.

Here is where we can see how much money is flowing out to different areas. This can give a sense of how much capital is being deployed across investment activities.

Furthermore, if the company holds any debt, we can see how much capital that might be draining from the business during the reporting period.

Final bite: balance sheet

Finally, the statement that is arguably mentioned the most during times of hardship is the balance sheet. This section of an ASX earnings report is a staple for fundamental investors to feast their eyes upon.

In short, the balance sheet is comprised of three parts: assets; liabilities; and equity. Though, it is the first two that tend to attract the most attention.

When reviewing a balance sheet, it is important to take note of the relationship between total assets and total liabilities.

If a company has substantially more liabilities, that would suggest it is using leverage/debt to grow, which can come with added risk. A common rule of thumb is a 40% debt to equity ratio. If the company's debt is less than 40% of its total equity, this is usually on the safer side.

Lastly, the cash and cash equivalents section will indicate how much liquid capital the company has at the ready. This can be used to fund growth through acquisitions or save for a rainy day.