The Transurban Group (ASX: TCL) share price is in the red on Wednesday, trading down 1.81% at the time of writing to $13.60 a share.

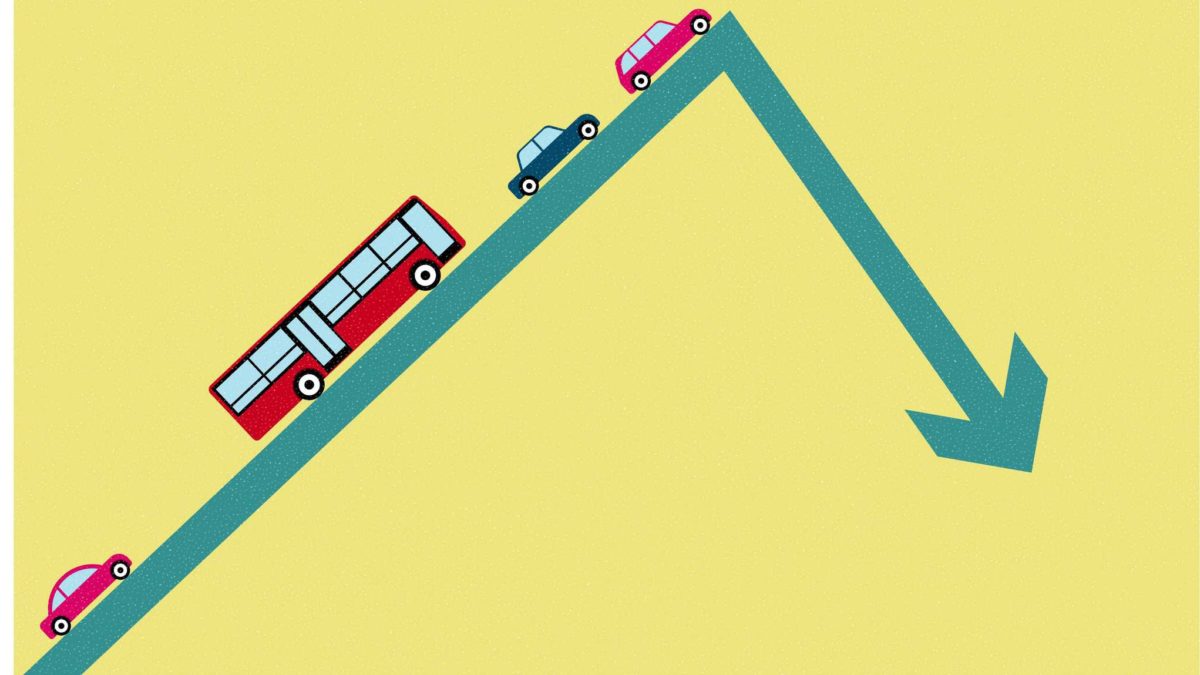

It seems shares in the toll company are facing multiple headwinds in today's trading session.

Let's take a look at why the Transurban share price is struggling.

What's weighing down the Transurban share price?

Shares in Transurban are facing several challenges today.

Weakness in the broader market has painted the exchange red with the S&P/ASX200 Index (ASX: XJO) currently 1.52% lower for the day.

In addition to weakness in the overall market, shares in Transurban are also pricing in a more direct challenge.

The company's infrastructure services have been on the receiving end of a targeted campaign from transport workers.

According to a recent article in the Australian Financial Review, one of Australia's largest trucking companies, Toll Group, has urged drivers to avoid using toll roads.

The Transport Workers Union (TWU) has also weighed in, advocating that trucking operators could not afford to keep paying rising toll fares.

In particular, the article highlighted new toll roads like Sydney's WestConnex where trucks typically pay three times the fares of cars.

As part of the action, the TWU has urged a review of current tolling regimes and more transparency on how toll fares are set.

More on Transurban

Shares in Transurban recently made headlines after the company launched a capital raising.

The infrastructure giant is looking to raise $4.2 billion to support its acquisition of the remaining 49% stake in the WestConnex from the NSW Government for $11.1 billion.

Transurban noted that WestConnex has close to 40 years concession life remaining.

As a result, additional highway extensions are expected to generate significant free cash and support distributions.

With the increased holding in WestConnex, Transurban's management expects to receive more than $600 million of potential capital releases until FY25.

The acquisition has resulted in mixed assessments from analysts and brokers.

Most recently, leading broker Citi issued a neutral rating on Transurban with a share price target of $13.78.

Analysts expect the company's acquisition of WestConnex could be dilutive in the near term.

Snapshot of the Transurban share price

The Transurban share price has been all over the place this year.

As a result, shares in the infrastructure giant are relatively flat since the start of the year.

At the time of writing, the Transurban share price is trading around 2% lower for the day.