The GameStop Corp (NYSE: GME) debacle has been depicted as a modern-day phenomenon enabled by social media and $0-fee trading platforms.

While technology definitely played a part, it's certainly not the first time everyday people feverishly punting on the share market has ruffled the feathers of professionals.

University of Tasmania lecturer Robbie Moore pointed out Tuesday that a big fad more than 100 years ago in the US were venues called "bucket shops".

These were places where ordinary folks could bet on the price movements of particular shares, without actually directly purchasing real shares.

It was a TAB for the stock market, if you will.

"Bucket shops were immensely popular," Moore told The Conversation.

"By 1889, the volume of shares wagered in bucket shops was 7 times larger than the volume of shares traded on the New York Stock Exchange. Bucket shops drew many more Americans – including women – into the thrill-ride of speculation."

And just like Robinhood and the GameStop saga, bucket shops were seen as a "democratisation" of a financial system that was even more inaccessible in those days.

The venues were popular with women, who still had immense barriers to directly participating in male-dominated financial markets.

And the shops also allowed middle-class men a peek into a world that only wealthy folks enjoyed at the time.

Finance industry gets defensive

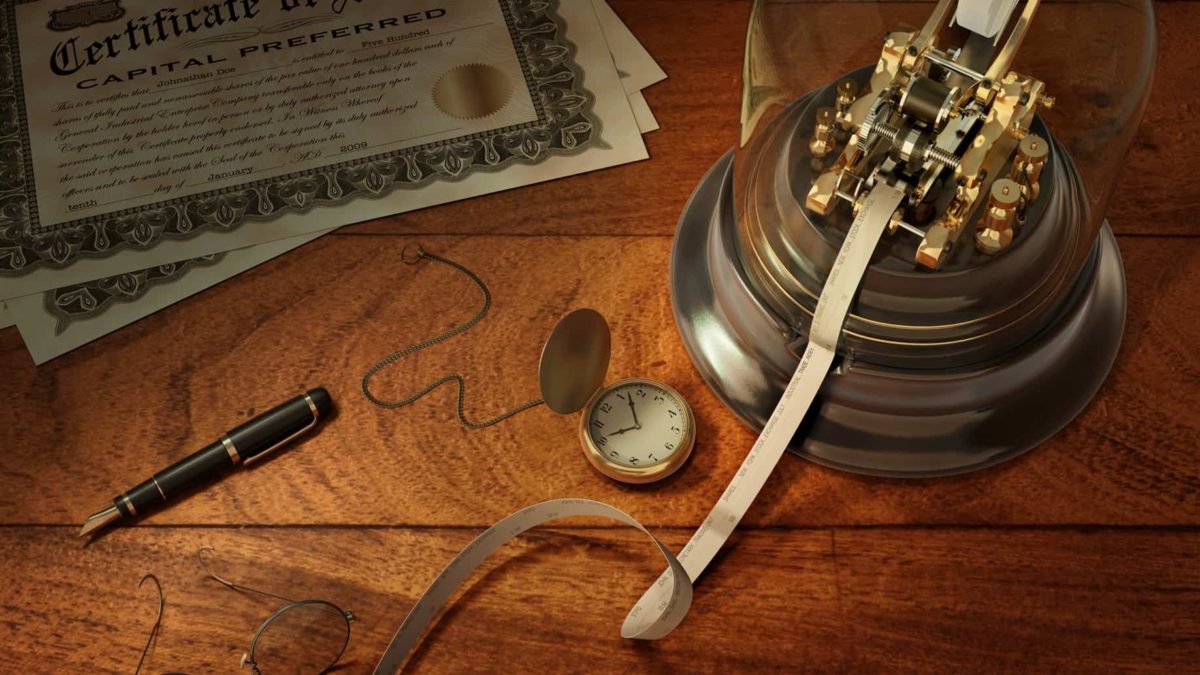

Bucket shops were decorated to look like private men's clubs, which the real stock market participants socialised in.

"Increasingly backed by big money and arranged in national chains, their interiors were often fitted with plush furniture and seductive technologies such as stock tickers and telephones," said Moore.

"This mimicry threatened the legitimacy of stock speculation."

This compelled professional share investors to label them as gambling dens – illegitimate and dangerous punting.

The same condescending tone has also been taken by current professionals to label the Reddit investors who triggered the GameStop frenzy.

"Writing on GameStop for the Washington Post, Sebastian Mallaby made the distinction between 'rational investors' who work to stabilise the market and keep prices realistic and 'honest', and the 'crazies' whose frenzied activity creates irrational prices," said Moore.

"We saw similar language used by the finance industry of a century ago, asserting the superior masculine equipoise and rationality of trained financial professionals compared to the 'hysteria' of bucket shop amateurs."

Axa SA (EPA: CS) core investments chief investment officer Chris Iggo said the GameStop crowd should be taken seriously.

"There is a temptation to be dismissive of the sort of 'casino capitalism' on show on Wall Street at the moment," he said.

"However, there is a risk, albeit small at this stage, of today's side-show having more meaningful implications for markets ahead."

Activism investors and hedge funds have much in common

Moore said that both the activist Reddit investors and the professional fund managers are "invested in myth making" and "false dichotomies", such as Robinhood vs The Man and the Rational vs the Rabble.

"But it is clear that both sides are more similar and more entangled than they would care to admit. This poses difficult questions for the finance industry as it tries to shut out the rabble while maintaining the status quo."

Much like the criticisms of Robinhood's gamified nature, early last century the finance industry criticised the use of telegraph stock tickers in bucket shops.

"Tickers transmitted stock information over telegraph lines, and were available for anyone to purchase," said Moore.

"One pro-Wall Street journalist described the ticker as a 'narcotic', while a doctor writing for the Medical Times described the illness of 'tickeritis'."

But professionals also used these machines. Of course, the finance industry argued qualified tape readers were cool and rational.

"The Tape Reader is like a Pullman coach, which travels smoothly and steadily along the roadbed of the tape, acquiring direction and speed from the market engine, and being influenced by nothing whatever," reads the 1910 book Studies in Tape Reading.

Iggo said the amount of retail money flying around the markets due to low interest rates, plus the retail activism, would scare off professional short investors.

This would naturally reduce the opportunities for future short squeezes, although the public consciousness of them could have a profound impact.

"The more the media focuses on it, the more the idea that the whole market is in a bubble takes hold," he said.

"The psychological impact could drive investors to take profits on their equity portfolios or hold back cash in case there is a market correction."