Altium Limited (ASX: ALU) is a top ASX tech share.

The Altium share price has edged 3.2% lower this year but remains up 638.4% in the last 5 years.

There's no doubt the coronavirus pandemic has hurt the company's valuation. Investors were spooked in March with demand and supply-side concerns.

Altium is set to report its full-year result on Monday 17 August. But does that mean now is your last chance to snap up this top 'WAAAX' share for a cheap price?

Why the Altium share price could be good value

I can't think of an earnings season with as much uncertainty as the one ahead.

Much of the February results are now rendered irrelevant by the pandemic. That means ASX share prices could be more dislocated than ever.

I think the fluctuating AUD–USD exchange rate could also be a factor. Altium has significant US earnings, which means the impact on the August full-year result is worth watching.

Altium's 14 July trading update gave me some confidence ahead of August. The company achieved a record 17% growth in its subscription base with over 50,000 subscribers. Revenue growth came in at 10% to US$189 million despite the pandemic.

What about the long-term outlook?

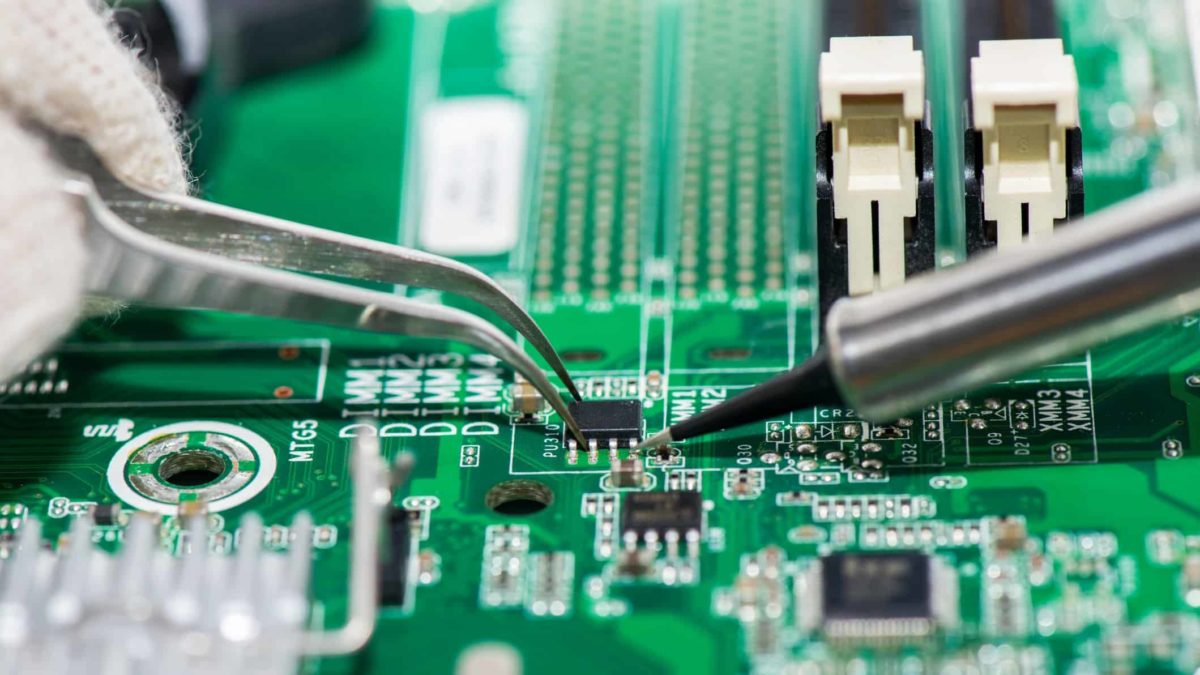

The long-term thesis for Altium does remain largely intact, in my view. Altium wants to be a leader and innovator in the printed circuit board (PCB) industry.

I think it has a strong competitive advantage and a high-quality product. The company's addressable market also remains large and I think if anything design software demand will continue to grow.

Is there any downside?

Unfortunately, yes. If investing in Altium shares was all upside then everyone would be doing it.

I think Altium ticks all the boxes in terms of market position and future potential.

The big downside here is that Altium shares trade at an enormous price-to-earnings (P/E) ratio. As of Thursday's close, the Altium share price traded at a 59.4 multiple. That means you're paying a lot today for potential growth in the future.

If Altium continues to kick strategic and financial goals, then that may not be an issue. However, one stumble along the way could result in a big share price drop, like we've seen with Nearmap Ltd (ASX: NEA) in recent times.

Foolish takeaway

I do think Altium shares could be headed higher in August. However, I think patience is key for long-term investors and I wouldn't be rushing to buy just yet.