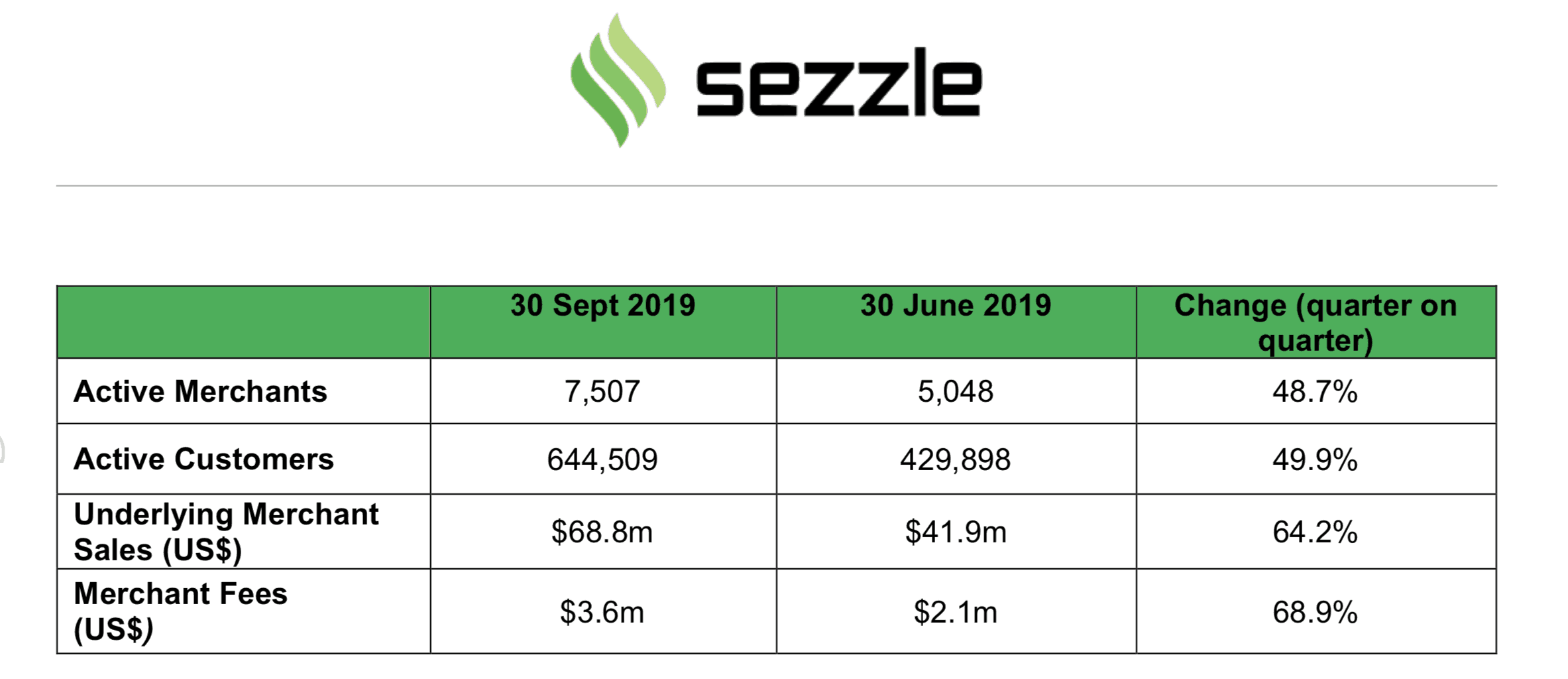

The Sezzle Ltd (ASX: SZL) share price is up 3.4% to $2.76 today after the buy-now-pay-later reported cash flows and operating metrics for the quarter ending September 30 2019. As a US-based operator Sezzle is targeting the less mature, but far larger U.S. consumer market and the table below speaks for itself on the headline numbers.

Source: Sezzle investor presentation, Oct 28, 2019

We can see that some of Sezzle's key operating metrics are all growing around 50% or more quarter-on-quarter.

This is the kind of gangbusters growth Afterpay Touch Group Ltd (ASX: APT) has consistently reported for several years to propel its share price into orbit.

What about the profitability?

Sezzle also reported that its net transaction loss (NTL) and net transaction margin (NTM) both trended in the right direction versus the prior quarter. The NTL is normally bad or doubtful debts as a percentage of merchant sales.

The NTM should equal Sezzle's income from merchants minus the NTL minus other variable transaction costs.

The higher the NTM expressed as a percentage the more profitable the business. While the lower the NTL expressed as a percentage the better.

These metrics are important to understand for investors as "explosive merchant sales growth" is useless if the BNPL operator is losing money on it. As ultimately the BNPL provider has to deliver operating, marketing costs, bed debts, etc, lower than income from merchants if it's ever to turn a profit.

For now Sezzle only reported the key NTM and NTL metrics are moving in the right direction, but did not break down actual comparable percentages.

This is notable as over the next quarter it will be harder for investors to get a read on how these metrics are travelling.

Cashflows

For the September quarter the operating cash loss came in at US$7.04 million on processed sales of US$60.95 million.

Payments to merchants came in at US$62.84 million on the sales of US$60.95 million, although the company has added a footnote to the statement stating receivables stand at US$6.7 million net of bad debts. If applied this would lower the lower outflow significantly.

For the December quarter it's estimating US$107.94 million of operating cash outflows with estimated payments to merchants of US$97.53 million offset by receipts from sales of US$94.9 million.

Again, this suggests another quarter of cash outflows and why it's reporting higher payments to merchants than receipts from sales is unclear.

Some investors will draw certain inferences from this given the company is involved in a big growth push in a ferociously competitive space.

We can see then that for investors in Sezzle, Afterpay or even Splitit Ltd (ASX: SPT) that it's important to consider not just 'growth rates', but how profitable that growth is or is not.

Fortunately for Sezzle investors it still has US$27.2 million cash on hand to fund its growth push in what is a clearly explosive space.