It appears leading Canadian cannabis business Canopy Growth Corp didn't get the 'buy low, sell high' pot stock memo after dumping its 42.08 million shares in Auscann Group Holdings Ltd (ASX: AC8) for just 15 cents per share.

The block trade equivalent to a 13% stake in Auscann went through last Friday afternoon with Perth-based asset manager Merchant Funds reportedly the buyer.

Remarkably, Auscann shares are changing hands flat at 32 cents per share this morning despite leading medical marijuana player Canopy wanting to get out at 15 cents per share.

I've warned many times how Auscann looks little more than a 'story stock" endlessly promoted to the media by its former CEO who has since quit with many of the insiders having a background in legislative functions or politics.

The company was set up prior to a series of well flagged legislative announcements making the pathway to commercial medical marijuana in Australia clearer and the stock soared to above $1.70 in January 2018 on the back of little more than promotion and the changing legislative environment.

For every buyer, there's a seller and for all those who are well underwater on the stock many will have made a fortune.

The only thing Auscann looks to have going for it is a cash balance of around $35 million as at June 30 2019, although this is likely to be whittled away over time as the company has zero revenue and posted a $5 million operating cash loss for fiscal 2019.

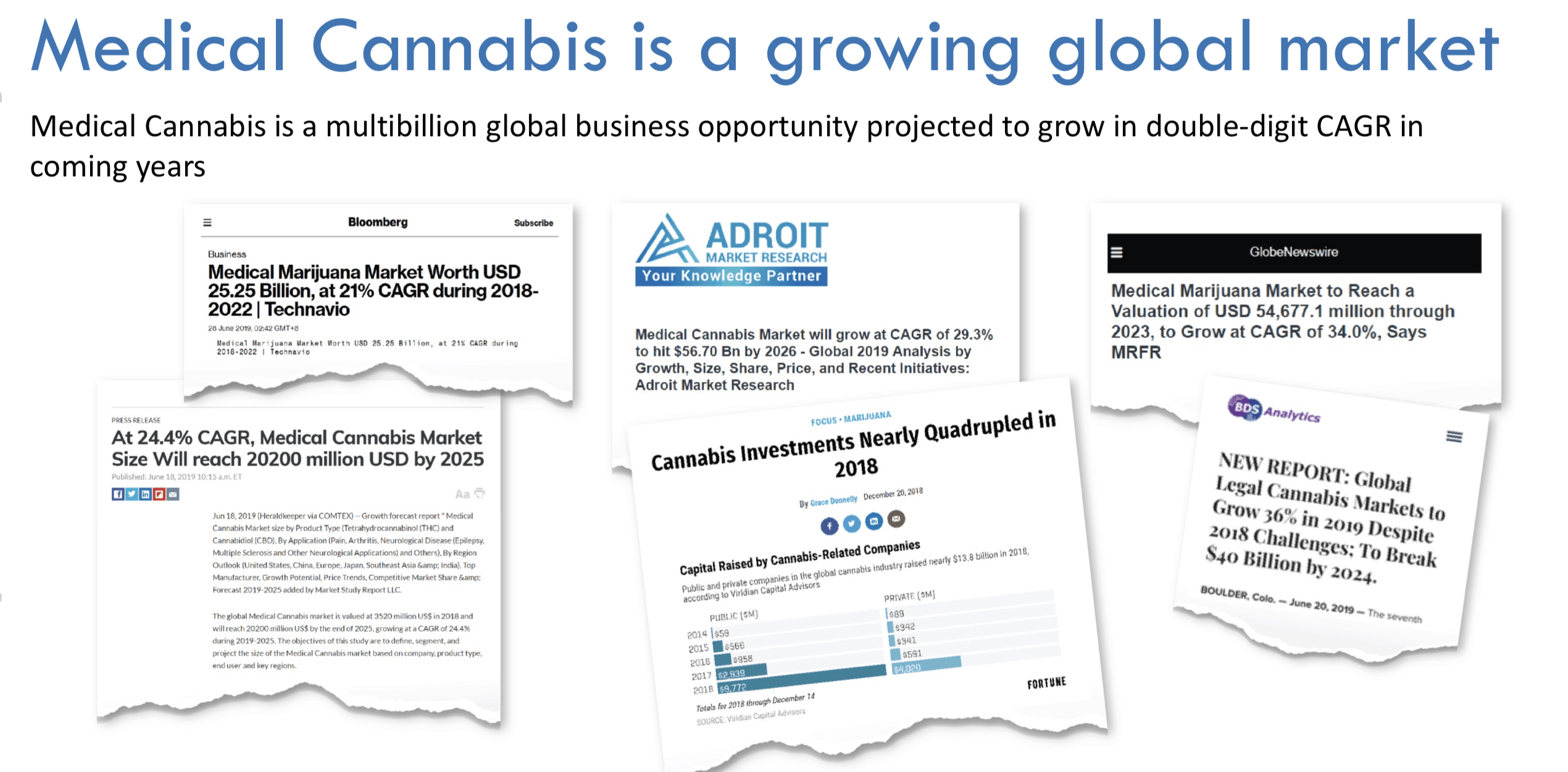

It also tends to promote itself in the media alongside estimates for the growth of 'medical marijuana' markets, rather than its own chances of ever making any money.

Check out page 6 of its latest September 2019 investor presentation which is just media cuttings some of which fall into the "churnalism" bucket of re-purposed public relations releases.

Source: Auscann presentation, Sept 11, 2019.

I would not go anywhere near this business myself and wouldn't value it at anymore than its cash backing (given cash is likely to be eroded in FY 20) which is a little less than the 15 cents per share Canopy got out at.

Other pot stocks to have predictably come back to financial reality include Cann Group Holdings Ltd (ASX: CAN), Althea Group Holdings Ltd (ASX: AGH) and MGC Pharmaceuticals Ltd (ASX: MXC).