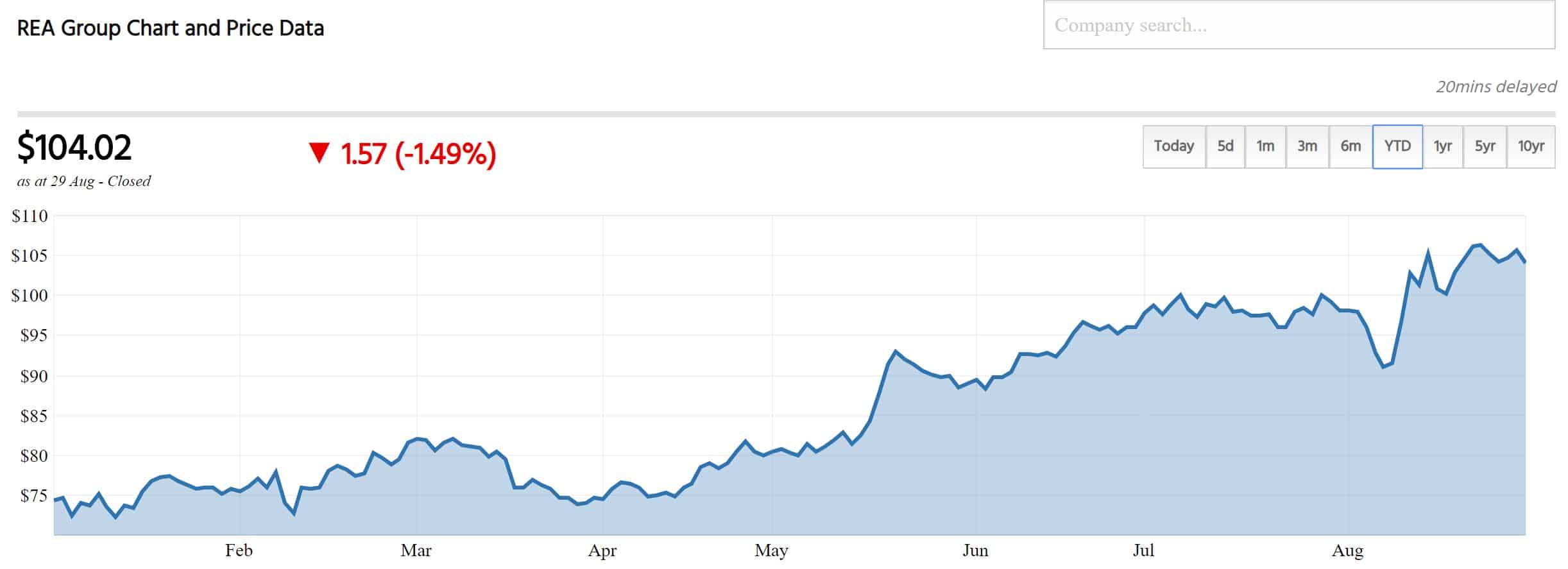

The REA Group Ltd (ASX: REA) share price has been on a tear over 2019 so far. REA shares started the year at $74.26, but as of market close yesterday, you would have to pay $104.02 for the privilege of owning this company. That's a gain of about 40% for the year (with four months left to go).

So what is it about REA shares that's driving investors crazy? Let's take a look at this digital titan.

Who is REA Group?

Although REA is not exactly a household name, its flagship website realestate.com.au is. If you've ever bought, sold or rented a house, you would probably have come across this website as it is the most popular of its kind in Australia – and by a long way too, with over 76 million monthly active users.

REA also owns flatmates.com.au – a site for finding… flatmates as well as realcommercial.com.au, which deals with office space and other commercial real estate. Capitalising on Australians' love of all things property, the company also has ambitious plans to gain a foothold in seemingly every inch of the industry. REA acquired the remaining stake of Smartline this financial year, which is a mortgage-broking franchise group. Realestate.com Home Loans – a digital-only lender in partnership with National Australia Bank Ltd (ASX: NAB) also adds to this firepower. The leveraging of its user base with offerings like mortgage-broking and home loans demonstrates the effectiveness of this company and explains how it has achieved such success.

Is the REA share price a buy today?

In its recently released results for the 2019 financial year, REA showed off many qualities that indicate is calibre. Revenue and earnings growth were both a healthy 8% and REA also bumped up its dividend by 8% to $1.18 per share. The company's trailing return on equity is also very respectable at 14.15%, which shows that management is very good at turning cash into more cash. In my view, it is for these reasons REA shares have shot the moon this year.

However, the market may be viewing REA with rose coloured glasses. Its current share price represents a price-to-earnings ratio of 133. When compared to the current market average of 17, REA shares are looking very pricey (a little too pricey for a company with an 8% earnings growth rate, in my opinion). My Foolish takeaway is that REA is a wonderful company at an unreasonable price. I'll be waiting for a cheaper price tag on this one before I'd buy in myself.