The Qantas Airways Limited (ASX: QAN) share price climbed on Monday as the market struggled to gain altitude and some experts believe the stock is poised to run higher.

Qantas share price gained 1.2% to a one-and-a-half month high of $5.90 when the S&P/ASX 200 (Index:^AXJO) (ASX: XJO) index clawed back from the red in late trade to finish a modest 0.3% higher.

Speculation that our national carrier may be included in a global stock index that is likely to drive increased interest from international investors.

"Qantas reported that offshore investors potentially held 40.8% as at 23 October 2018, down from 43.35% as at 24 July 2018," said Credit Suisse.

"On this basis, Qantas is in position to qualify for inclusion in the MSCI Global Investable Market Indexes (MSCI Index) meeting the MSCI requirement of foreign room of at least 15%."

Ironically, inclusion into the MSCI index will likely send the proportion of offshore investors in Qantas soaring higher, although the good news is that there is now more space on the airline's share register to accommodate them as Qantas has a 49% foreign ownership cap.

Throw in the added tailwind of waning crude oil prices (assuming the downtrend can be sustained) and you can see why some like Credit Suisse are urging investors to jump on board.

But that's not the only transport-related stock that is winning favour with the market. Logistics group Brambles Limited's (ASX: BXB) share price also outperformed strongly yesterday with a 2.2% jump to a one-month high of $10.79.

It was a slump in the US lumber price that is probably behind the stock's outperformance as Credit Suisse estimates that lumber cost is typically 11% to 12% of Bramble's annual revenue in terms of operating expenses and capital expenditure.

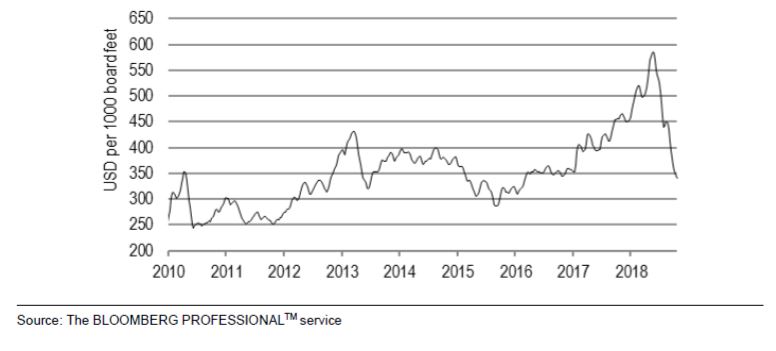

US lumber prices have tumbled nearly 42% since June to just under US$350 per 1000 board feet. That is the lowest in more than a year.

Timber! US lumber price at a one-and-a-half year low

This means Brambles could report a significant increase in profit margins during next February's reporting season.

Easing crude prices is also a boon to the group, which has been struggling with rising costs and the lack of operational leverage even though it's theoretically well placed to benefit from the booming US economy.

Credit Suisse has an "outperform" recommendation on both stocks with a price target of $6.70 on Qantas and $11.50 on Brambles.

But these aren't the only stocks worth putting on your watchlist. The experts at the Motley Fool have three other blue-chip stocks that they believe are well placed to outperform in FY19.

Click on the free link below to find out what these stocks are.