In morning trade the Monash IVF Group Ltd (ASX: MVF) share price has tumbled lower by over 10% to $1.15 following the release of its results for the 12 months ended June 30.

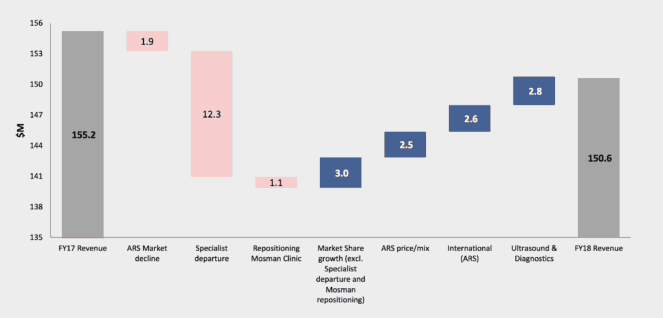

In FY 2018 the fertility treatment company posted revenue of $150.6 million, earnings before interest, tax, depreciation and amortisation (EBITDA) of $38.1 million, and net profit after tax of $21.4 million. This was a decline of 2.9%, 22.2%, and 27.9%, respectively, on the prior corresponding period.

Basic earnings per share was 27.8% lower year-on-year at 9.1 cents, leading to the Monash IVF board slashing its full year dividend by 31.8% to 6 cents per share.

As you can see above, the main cause of the company's revenue decline in FY 2018 was the loss of its key Victorian fertility specialist, Dr Lynn Burmeister. This offset its market share gains, favourable price/mix from its assisted reproductive services (ARS), and growth in its International ARS and Ultrasound & Diagnostics segments.

It was Dr Burmeister's exit that also weighed on its margins and profits in FY 2018. Monash IVF's EBITDA margin fell from 31.6% in FY 2017 to 25.3% in FY 2018 due to leverage impact from volume decline in Victoria. An increase in its cost base from $106.3 million to $112.5 million also added pressure to its margins.

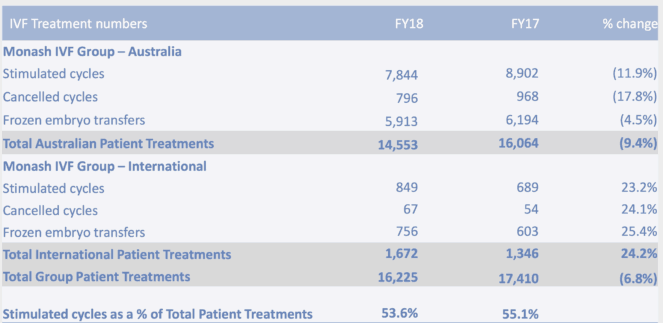

The table below demonstrates the impact that Dr Burmeister's exit has had on patient treatments in FY 2018.

Although the company is expected to return to growth in FY 2019, it won't be until the second half of the year according to management. Due to Dr Lynn Burmeister operating for one quarter in the prior corresponding period, net profit after tax in the first half is expected to decline by 15%.

Should you invest?

While Monash IVF may be over the worst of it now, I intend to keep my powder dry until at least the release of its first half results. At that point investors should be able to see whether the company returned to growth in the second quarter when comparisons became fairer.

In the meantime rival Virtus Health Ltd (ASX: VRT) could be worth a look or even pharmaceutical company Mayne Pharma Group Ltd (ASX: MYX).