Shares in the aerial imagery technology company Nearmap Ltd (ASX: NEA) were up 19% today after the company announced that it had exceeded its own guidance for Annualised Contract Value (ACV) growth in FY 2018.

Here are the key highlights from the announcement:

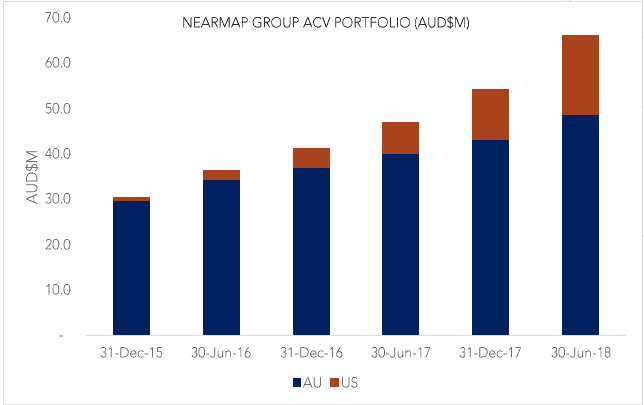

- 41% growth in closing Group ACV with a 30 June 2018 balance of $66.2 million compared to $47 million as at 30 June 2017

- Both the US and Australian operations exceeded H2 FY 2018 guidance for ACV growth as follows:

- Australia ACV growth was $5.5 million (guidance was $3.3 million)

- US ACV growth was US$ 4.4 million (guidance was US$3.2 million)

- The US portfolio more than doubled with 143% ACV growth, the fastest in its history and faster than the Australia operations for the first time in Nearmap history

- Cash balance of $17.5 million as at 30 June 2018 compared to $20.6 million as at 31 December 2017

Nearmap CEO Dr Rob Newman said, "We are encouraged by these results and the progress we are making in building our subscription bases both in the US and Australia". That leads me to two things about Nearmap's business that could be exciting for shareholders.

Subscription model

I love companies with a subscription business model with revenue typically received upfront and when combined with consistent growth, it can provide investors with compounding returns for a very long time.

I think the key things for investors to look out for when Nearmap makes its full FY 2018 results announcement will be:

- The churn rate– the percentage of customers who did not renew their subscriptions. This was 9.3% for the 12-month period ended 31 December 2017.

- The average revenue per subscription– investor will want to see this increase over time.

- Portfolio lifetime value– this will reflect the size of the group's portfolio but more importantly, the impact of margins and churn rate on this number will be important.

Long-term growth potential of the US

The US is a large market and if Nearmap can continue gaining traction there, it could be very rewarding. The chart below from the company's ASX announcement shows the growth in the US as a percentage of Group's total ACV portfolio.

Foolish Takeaway

As with most tech companies, Nearmap shares aren't cheap and they are priced for growth. Even a minor setback could send its shares tumbling down but as things stand, the company is certainly on the right track.

Nearmap shares are now up an incredible 100% since the beginning of 2018 when shares were trading at $0.60. If you are looking for more ASX small-cap shares that are providing high returns for shareholders then you won't want to miss this FREE REPORT.