ARB Corporation Limited (ASX: ARB) is a company I would love to own, but it is expensive.

ARB Share Price

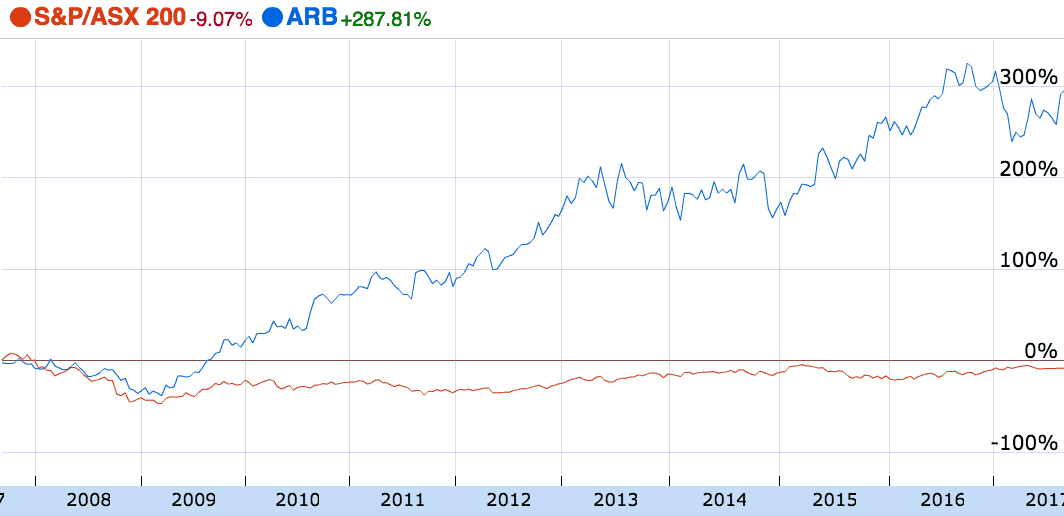

The chart above shows ARB Corp shares versus the S&P/ASX 200 (Index: ^AXJO) (ASX: XJO). It has thumped the market.

Results

On August 16, ARB Corp, Australia's premier 4×4 parts and bull bar business, released its results, which were solid. Profit up. More stores opened. Ongoing international growth. Superior manufacturing capabilities. Dividends up (again). No debt. Just cash.

Pleasingly, the company also hinted that its USA venture is looking up:

"The relatively high Australian Dollar against the US dollar limited the impact of excellent growth in the USA. Exports now represent a healthy 27.6% of ARB's total sales."

Is it still overvalued?

In my opinion, ARB Corp would be the ideal company for long-term investors, such as those who follow the investing of Warren Buffett. I wrote in May that ARB Corp has the makings of a great investment, given it is family run and a market leader, among other things. However, I wrote at the time that its shares are expensive.

While the latest result was solid, its shares are still quite pricey. In my opinion, it will need to be successful internationally for the current price to go on to thump the market. Admittedly, last month's results were a step in the right direction.

Unfortunately, I cannot help but think that there may come a time when patient investors can buy ARB Corp shares cheaper in the future.

Foolish Takeaway

If you are a long-term investor I think it makes sense to pay a fair price for a great company. What I mean is, if you are buying poor businesses, you need to buy them cheaply. But if you are buying great businesses you can pay a higher price because time is the friend of a wonderful business.

However, I think ARB Corp shares are even higher than fair value right now. So, for now, I'm still waiting on the sidelines.