It's always an honour to help someone begin their investing journey, but as a full-time investor myself, it's easy to forget that sometimes people need a little help with the basics.

Today, we're going to take a moment to answer a question I received recently:

What is a limit order and how do I use one?

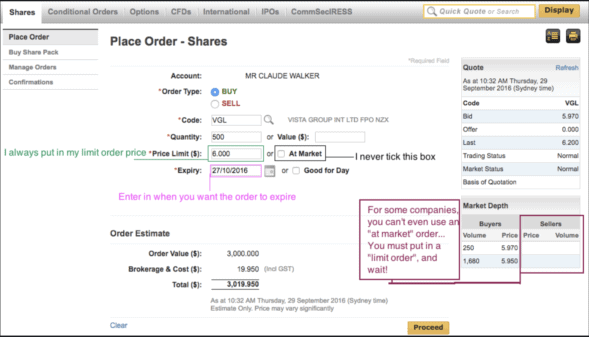

Well, a limit order is an order to buy or sell shares at a specified price. This price is your limit. A most online brokers the default duration of a limit order is 30 days. That means that if it is not filled after 30 days, the order will expire. You can see what I mean in the screenshot below, from CommSec.

With CommSec, using a limit order is as simple as not ticking the "at market" box. Other online brokers also make it very easy to use a limit order… simply call their customer support number if you are not sure.

If you use a traditional full service broker, you can simply tell them the exact price you want to buy or sell at. However, small investors should use an online broker, because commissions are much lower.

Limit orders are better than 'at market' orders

Limit orders are a more deliberate and thoughtful way to buy shares than the alternative. Each time you place one, you know the price you are willing to transact at. I've made many profitable investments, simply by placing a hopeful limit order to buy shares at a price I find attractive. That puts me in a prime position to profit from other investors who might sell "at market". If my order is the highest bid, the "at market" seller will come down to meet my price, and I'll profit from their impatience (on average).

The downside of this strategy is that I might end up buying shares right at the moment some bad news arrives. Therefore, investors must not place large "at limit" orders, and then forget about them.

But even if you never "set and forget" a limit order, you should still use them. You can simply set the limit order at the price of the highest bid or offer and you will therefore minimize the chance that high frequency traders (HFT) will take advantage of you. HFT algorithms can easily take advantage of large "at market" orders, by getting ahead of the order in the queue, and selling back to the buyer at a slightly higher price.

The habit of using limit orders can improve your returns in other ways. For example, when a company's shares spike up or down on news, it is usually because a whole lot of people are placing "at market" orders, all at once. Oftentimes, those same investors could have sold at a higher price, or bought at a lower price, just hours (or even minutes) afterwards, simply by placing "at limit" orders. That's because, even with large companies, a rush of "at market" orders can cause irrational spikes, with some investors then dismayed at the price they received. This is especially true for small-cap companies.