Before I start, don't forget my EOFY sale on Motley Fool Share Advisor subscriptions ends soon. Click here now to lock in your 60% discount, and get Scott Phillips' latest stock pick, hot off the presses.

Up, up and away.

The ASX is back on the up again today, jumping 40 points or 0.8% higher.

Throw the end of financial year (EOFY), Credit Suisse's shiny new 6,000 target for the S&P/ASX 200, and low interest rates for the foreseeable future, and it all adds up to the potential for a meaningful stock market rally ahead.

Not before time too, if you ask me.

While U.S. markets have regularly been making new all-time highs, the ASX has been stuck in a narrow trading range. But all that could be about to change, especially if I'm right on BHP Billiton (ASX: BHP).

More on the Big Australian a little further down…

Speaking of U.S. markets, the S&P 500 is poised for a fifth month of gains, all of which prompted one pundit on Bloomberg to say…

"The market is partying on. If you think about it over a slightly longer-term basis, Fed tightening is not on the horizon, corporate outlook is fine, and if you look at dividend yields, stocks are attractive from a valuation point of view."

The exact same things could be said about the Australian market, minus the party.

Imagine what might happen should the ASX party get into full swing here… look out 6,000, and more!

I'm not hanging around waiting for the party to start, putting even more money to work just yesterday.

For compliance, disclosure and regulatory reasons, I can't name the small-cap tech stock I just bought.

What I can tell you is the company came on to my radar after it recently upgraded its profit outlook, yet the stock has fallen 16% in just the last few days.

I couldn't resist, hoping I've picked up a bargain. The company has no debt, trades on a P/E of less than 8, the 8.4% dividend yield being the icing on the cake. It's just the type of small-cap stock I look for — overlooked, beaten down, and on sale.

No guarantees, of course, especially as this is a higher risk company, but I think the odds are in my favour.

One mistake many investors make is assume you can only make outsized returns by investing in high risk stocks.

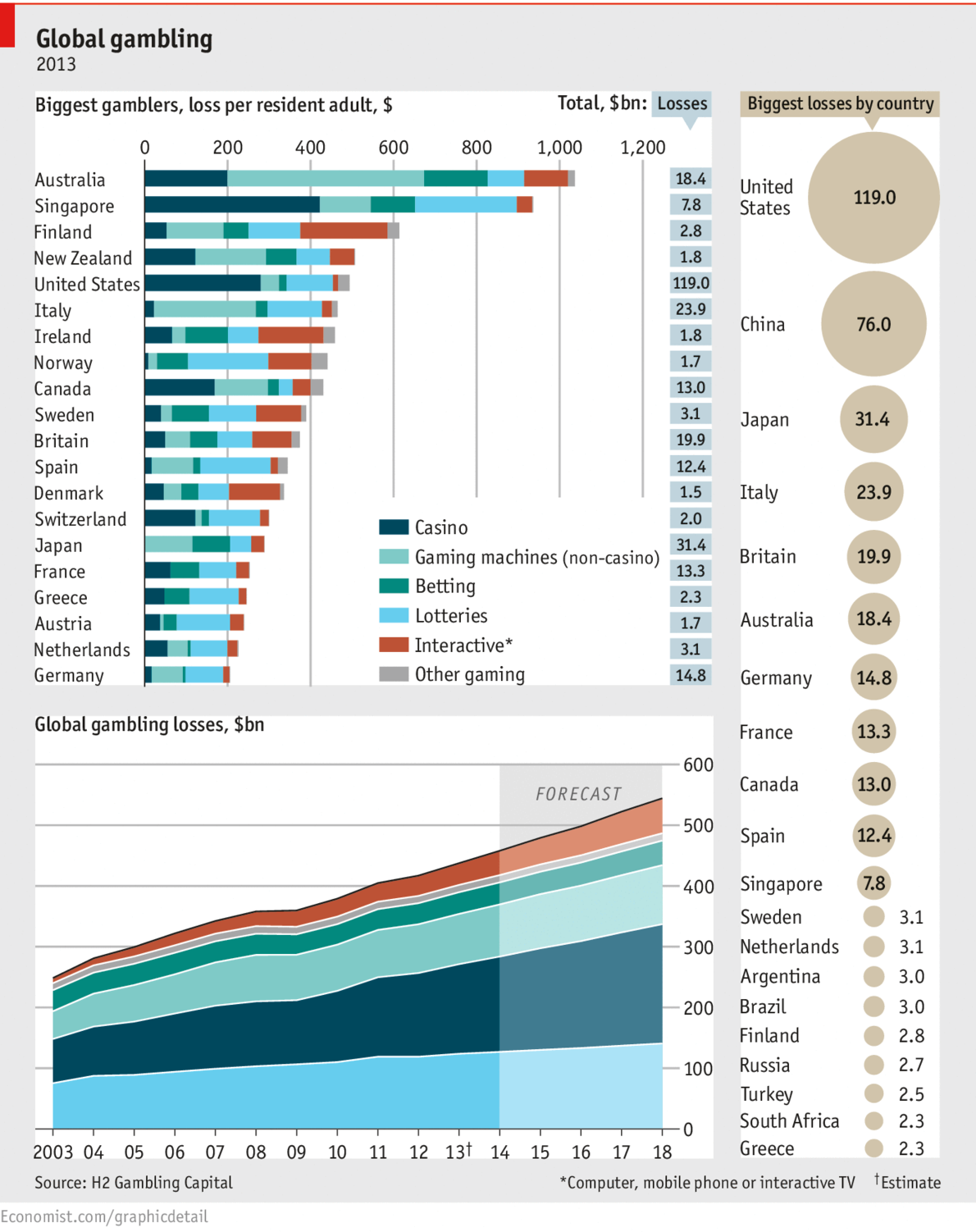

I know many of you like a punt — Australians gamble (and lose) more than anyone else on a per-person basis on the planet.

Admittedlty, most of those losses come from poker machine addicts, none of which (sadly) will be reading this email.

As well as poker machines, many Australians like a punt on the stock market.

Scott Phillips can't work it out — you'd never find him tipping such high risk stocks to subscribers of Motley Fool Share Advisor — as he thinks such 'investing' is a one way ticket to the poor farm.

That said, he understands the lure of rags to riches, and the pennies to dollars stories that are legendary.

The sad truth is for every Fortescue Metals Group (ASX: FMG) and today's hot stock, Liquefied Natural Gas Limited (ASX: LNG), there are many more fallen heroes, including gold producer St. Barbara Limited (ASX: SBM), down a wealth-destroying 94% over the past three years.

There is another way to build significant stock market wealth…

From very modest means, my parents accumulated a small investing fortune by buying, holding and reinvesting the dividends in blue chip stocks like Commonwealth Bank of Australia (ASX: CBA) and Woolworths Limited (ASX: WOW), both stocks going up well over 1000% since their IPOs in the early 1990s.

Not too risky, hey?

Another bloke who has made a ton of money is Warren Buffett.

His number one rule of investing is "don't lose money." His number two rule is "don't forget rule number one." That immediately counts out high-risk mining stocks.

The man is worth $65 billion today, having added $165 million to his fortune just yesterday, according to Bloomberg, not that he'll be counting.

You can be sure Buffett didn't gamble his way to $65 billion. He even missed buying shares in his mate Bill Gates' Microsoft Corporation, the hottest stock of the 1990s, and he is still worth $65 billion!

I mentioned BHP Billiton above. I already own it in my portfolio, and am looking to add some more.

Finally, BHP is showing some signs of life.

The iron ore price is stabilising. The AFR reports BHP's petroleum business in the United States is set to be boosted by initial moves from the Obama administration to relax a 40-year ban on exporting oil.

And then there is BHP's fully franked dividend. When franking credits are included, the stock trades on a grossed up dividend yield of over 5%… putting the returns of term deposits to shame.

BHP is up a dollar or so since I named it last week as "fully franked and fully on sale."

It's a good start.

BHP Billiton will never be the ASX's hottest stock, but if the S&P/ASX 200 is to hit 6,000, given the already lofty valuation of bank stocks, BHP will have to do a fair chunk of the heavy lifting. I look forward to enjoying the ride, and the dividend.