The Woodside Energy Group Ltd (ASX: WDS) share price is slipping today.

Shares in the S&P/ASX 200 Index (ASX: XJO) energy stock closed yesterday trading for $29.14. After opening slightly higher on Friday, shares are currently swapping hands for $29.00 apiece, down 0.5%.

For some context, the ASX 200 is down 1.3% at this same time.

Here's what's happening in global oil markets.

Woodside share price slides despite rising oil price

Aside from oil, Woodside earns much of its revenue from LNG. But higher oil prices tend to usher in higher natural gas prices as well.

But the Woodside share price isn't shaking off the broader market sell-off today despite both Brent crude oil and West Texas Intermediate (WTI) hitting new 2024 highs overnight.

Brent crude oil gained 1.7% to trade for US$85.62 earlier today and is currently trading for US$85.42 per barrel. That's up from US$75.89 per barrel on 2 January. And the highest level since November.

It's a similar story with WTI. The US crude oil benchmark is trading for US$81.06 per barrel. On 2 January that same barrel was worth US$70.38.

Commenting on the rising oil price that's so far failed to help lift the Woodside share price today, Dennis Kissler, senior vice president of trading at BOK Financial said (quoted by Reuters), "Demand is staying high, while supplies are getting tighter, particularly on the fuel side. The refining margins are also very strong and a positive for crude demand."

Traders have been bidding up the oil price after the US Energy Information Administration (EIA) backtracked on its previous forecast of a global oil surplus in the second half of 2024.

With OPEC+ likely to maintain its production cuts through the latter half of the year, the IEA now forecasts a modest supply deficit.

That comes even with near-record output from the United States, the world's top oil producer, with other non-OPEC nations also increasing their output.

Oil is also rising despite ongoing concerns over China's sluggish economic growth, which is likely to impact energy demand in the middle kingdom this year.

Nonetheless, inventories are shrinking.

"Because of falling inventories, we now expect the Brent crude oil spot price will average $88 per barrel in 2Q24," the IEA stated earlier this week.

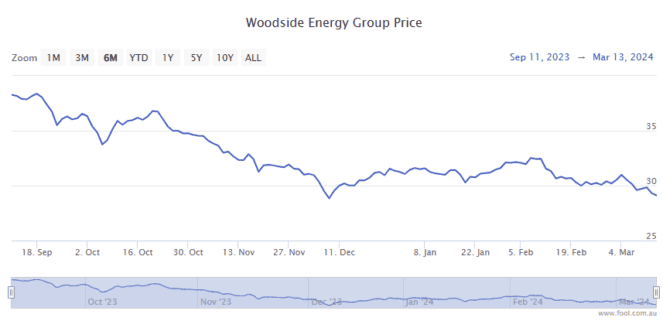

Despite the big uptick in the oil price this year, the Woodside share price remains down 6% in 2024.