The Liontown Resources Ltd (ASX: LTR) share price is charging higher today.

Shares in the S&P/ASX 200 Index (ASX: XJO) lithium stock closed yesterday trading for $1.32. At the time of writing on Wednesday, shares are swapping hands for $1.45, up 10.3%.

For some context, the ASX 200 is up 0.1% at this same time.

Here's what's happening.

ASX 200 lithium miner lifts off on funding agreement

The Liontown share price is racing ahead after the miner announced it has entered into a $550 million debt facility agreement.

The money will be used to ensure the Kathleen Valley Lithium Project, located in Western Australia, is funded through to its first production and the ramp-up to the company's three million tonnes per year (Mtpa) base case.

The debt facility has flexible terms that enable refinancing prior to maturity if drawn.

The miner said there were no scheduled repayments and interest capitalised during the term of the debt facility, with a bullet payment due on maturity on 31 October 2025.

Liontown will use the proceeds drawn to refinance existing Ford debt, as well as fund construction and ramp-up of the Kathleen Valley Lithium Project. The debt facility will also provide working capital and liquidity.

Commenting on the $550 million funding that's boosting the Liontown share price today, CEO Tony Ottaviano said, "Having this funding in place provides strong endorsement for our project and a platform of financial certainty from which to move forward."

Ottaviano added, "We are consequently well-positioned to deliver the remaining milestones to first production mid-year and ramp-up towards anticipated positive cashflows."

Liontown expects to initially draw down on the debt facility in early Q3 CY 2024.

Liontown share price snapshot

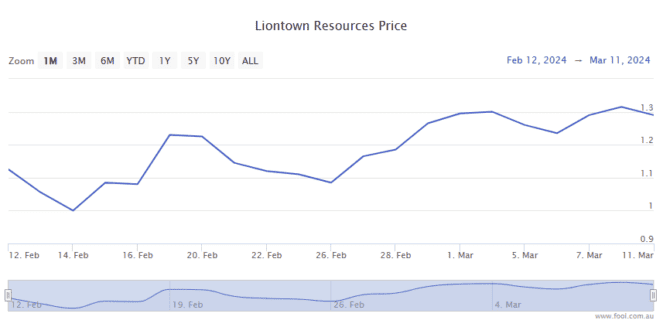

With today's intraday moves factored in, the Liontown share price is down 15% year to date.

Over the past month, however, shares in the ASX 200 lithium miner have now soared 41%.