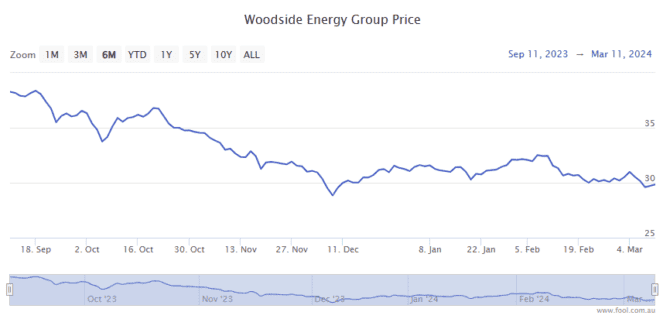

The Woodside Energy Group Ltd (ASX: WDS) share price has tumbled almost 24% over the past six months.

As you can see on the chart below, on 13 September shares in the S&P/ASX 200 Index (ASX: XJO) energy stock closed the day trading for $37.85 apiece.

In intraday trading today, shares are swapping hands for $28.92.

Now, the Woodside share price certainly could soar by 31% to reach $37.85 again. In fact, I believe that over the longer term, it probably will.

But I think that a 20% gain is more likely over the coming months.

Six months ago, Brent crude oil was trading for US$92 per barrel, compared to US$82 per barrel today. And while I believe the crude oil price will head higher this year, it would likely take some very unwanted escalations in the Middle East tensions to get it back above US$90 in 2024.

Still, I expect we'll see Woodside stock trading back near the US$35 range we saw in late October when Brent crude was selling for US$87 per barrel.

Why the Woodside share price could soar by 20%

Despite ongoing concerns related to climate change, work at Woodside's offshore Scarborough LNG project has recommenced. That offers additional long-term tailwinds for the Woodside share price.

And the company is working hard to address carbon reduction.

"Our climate strategy is integrated throughout our corporate strategy as we provide the energy our customers need today and into a lower carbon future," CEO Meg O'Neill told investors.

She added that the company's climate action plan is intended to "create and return value" to its shareholders while enabling Woodside to conduct its business sustainably.

Other tailwinds I see for the Woodside share price are the sizeable ongoing production cuts from OPEC+.

Despite near-record output from the United States, OPEC+ is managing to reduce global supplies.

According to the US Energy Information Administration (EIA):

As a result of OPEC+ extending crude oil production cuts, we have reduced our forecast for global oil production growth in 2024. The lower growth contributes to significant global oil inventory declines in our forecast for the second quarter of 2024 (2Q24)

And that's likely to lead to higher energy prices, which should support the Woodside share price.

"Because of falling inventories, we now expect the Brent crude oil spot price will average $88 per barrel (b) in 2Q24," the EIA noted. The agency expects Brent crude oil prices will average US$87 per barrel over 2024.

That forecast puts the oil price back to late October 2023 levels, when Woodside was trading for US$35 a share, some 20% above current levels.

Then there's LNG, which comprises a large part of Woodside's revenues.

According to the EIA, "We expect the US benchmark Henry Hub natural gas spot price to average higher in 2024 and 2025 than in 2023."

Atop a potential 20% gain for the Woodside share price amid rising energy prices, the ASX 200 oil and gas stock also trades on a trailing dividend yield of 7.5%.