A tiny ASX mining share is soaring on Friday after announcing a joint venture (JV) agreement with S&P/ASX 200 Index (ASX: XJO) mining giant Fortescue Metals Group Ltd (ASX: FMG).

The junior ASX miner closed yesterday trading for 4.5 cents. In early morning trade shares were swapping hands for 8.0 cents apiece, up 77.8%. After some likely profit taking, shares are trading for 6.9 cents at time of writing, up 53.3%.

Any guesses?

If you said Magmatic Resources Ltd (ASX: MAG), go to the head of the virtual class.

Here's what's happening.

Magmatic Resources share price leaps on Fortescue deal

The Magmatic Resources share price is rocketing after the ASX mining share reported it had executed a Farm-in and JV agreement with Fortescue subsidiary FMG Resources Pty Ltd.

The agreement will see Fortescue join Magmatic in exploring the Myall copper-gold project, located in New South Wales. The Myall Project consists of a contiguous 244 square kilometre tenement covering the northern extension of the Junee-Narromine Volcanic Belt.

Fortescue will spend up to $14 million under the agreement to earn up to 75% joint venture interest in the project.

Magmatic Resources will be the operator of the project during the initial Farm-in period of up to four years.

Fortescue will subscribe for 75,946,151 shares in Magmatic Resources. That will see Fortescue holding a 19.9% stake in the junior ASX mining share. Fortescue will pay 4.884 cents per share, which will raise just over $3.7 million for Magmatic Resources.

Magmatic Resources said it will deploy the funds to advance its two other projects in parallel with Myall.

Commenting on the agreement with Fortescue sending the ASX mining share rocketing today, Magmatic Resources executive chairman David Richardson said:

Myall has many of the signatures of a Tier 1 copper-gold deposit and Magmatic has recognised the need to partner with a major to further advance the project following the maiden Resource.

Fortescue's cornerstone investment in MAG will allow the Company to simultaneously advance our other two projects at Wellington North and Parkes which are strategically located near Alkane Resources Boda-Kaiser deposits and Tomingley Gold Operations respectively.

How has the ASX mining share been tracking?

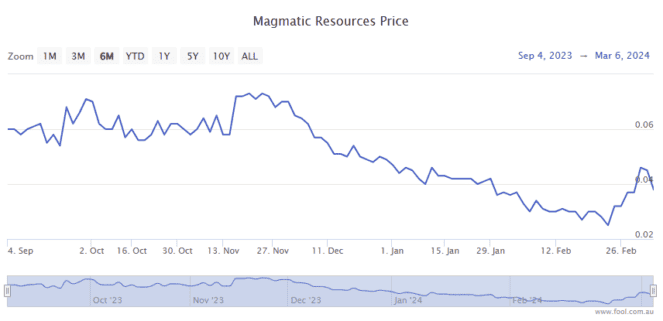

With today's intraday gains factored in, the Magmatic Resources share price is down 20% over the past 12 months.

The ASX mining share has soared 130% since the recent 26 February lows.