The All Ordinaries Index (ASX: XAO) share GQG Partners Inc (ASX: GQG) has risen strongly. Does it have a low enough price/earnings (P/E) ratio to buy?

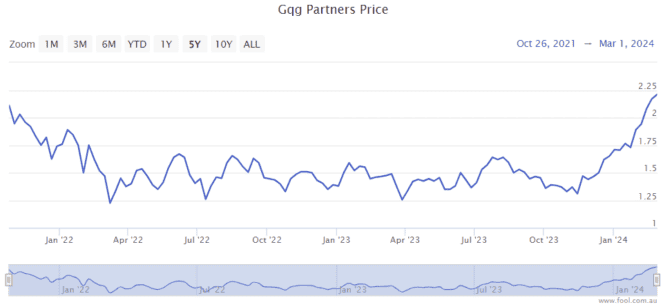

GQG shares have risen 50% in the past six months, soundly outperforming the 6% increase for the S&P/ASX 200 Index (ASX: XJO).

The fund manager was very undervalued before, and I still think the ASX All Ords share is undervalued now, following continued growth.

Why 2024 looks like another good year for the All Ords ASX share

The funds management space is difficult for the industry as a whole. Low-cost exchange-traded funds (ETFs) are capturing a lot of investment inflows.

However, not all fund managers are suffering, GQG is one of the rare ones doing very well.

In the 2023 full-year result it reported net flows of US$10 billion, a 14.7% increase of the average funds under management (FUM) to US$101.9 billion, a 17.4% rise in distributable earnings to US$297.9 million and a 17.3% rise in the dividend per share to US 9.1 cents per share.

Those numbers are impressive, but they tell us about the past. What about the future?

The average FUM for 2023 was US$101.9 billion and closing FUM at December 2023 was US$120.6 billion. That implies an 18% increase of FUM, if the FUM weren't to change. But, it has changed – FUM at January 2024 was US$127 billion (with net inflows of US$1.9 billion), 24.6% more than 2023's average FUM.

Unless there's a sustained crash of the global stock market, it seems GQG is on track to report an increase in earnings (and the dividend) of more than 20%.

Fund managers are typically scalable businesses – if FUM rises by 10%, it doesn't require 10% more employees or 10% more office space to manage that increased capital. Profit margins can rise as FUM grows.

Cheap valuation

If we assume a 20% rise in EPS for the ASX All Ords share in 2024, it would put the GQG share price at under 13 times FY24's possible earnings with a potential dividend yield of 7.6%.

I'm not going to assume that GQG's FUM can grow forever, but for the next year ahead it still looks undervalued with how well its investment funds are performing and how much it's bringing in with net inflows.

If the ASX All Ords share can keep increasing its geographical footprint and winning new clients, it may have an extended growth runway that the market isn't appreciating. The attractive flow of dividends is helping boost returns.