CSL Ltd (ASX: CSL) may be the third-largest stock on the S&P/ASX 200 Index (ASX: XJO). But unlike most of its peers in the top echelons of the ASX 200, CSL is not well-known as a generous dividend payer.

In fact, out of the ASX 200's top ten shares, CSL is currently one of only two shares that today offers a dividend yield of under 3% (the other being Goodman Group (ASX: GMG)).

However, this simple observation hides what has been a fairly compelling dividend growth story for CSL shares and their owners. So today, let's dive into the dividend growth history of the CSL share price.

What is a dividend growth rate?

A dividend growth rate simply refers to the consistency and magnitude of a company's dividend growth over time. If a company pays out $1 per share in dividends in one year, but $1.10 in the next and $1.20 in the year after that, we can say it has an average dividend growth rate of 10% per annum.

Of course, many companies don't consistently grow their dividend every single year. Many, particularly cyclical shares like mining companies, adjust them from year to year based on how much profits they are raking in.

Fortunately for lovers of consistently rising dividends, CSL shares fall into the former category.

What is the growth rate of the CSL dividend?

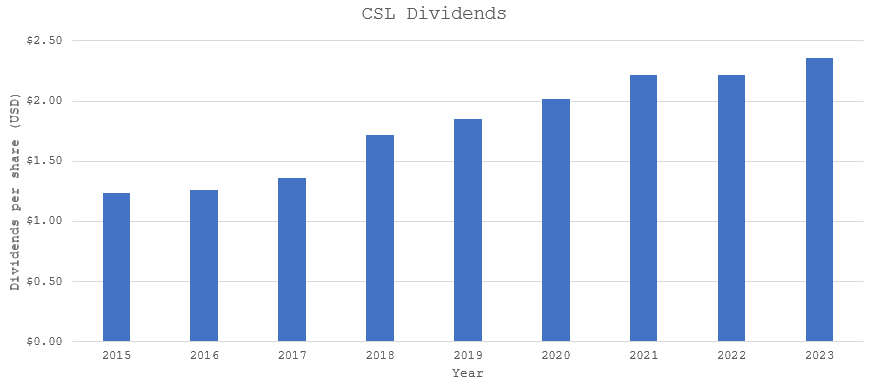

CSL shares have raised their shareholder income every single year since 2015, bar one. Back in 2015, shareholders enjoyed an annual total of US$1.24 per share. But by 2023, this had risen to US$2.36 per share.

That's following an annual dividend pay rise every single year except 2022. That year, investors enjoyed the same US$2.22 per share that they did in 2021.

Here's what that looks like in visual form:

Over the eight years from 2015 to 2023, CSL's annual dividend rose from US$1.24 per share to US$2.36. This works out to represent an average compounded annual growth rate, and thus dividend growth rate, of 8.38%.

Not something you might assume when looking at the current CSL share price's trailing dividend yield of 1.21%.