ASX investors looking to get in on the billionaire-making artificial intelligence (AI) revolution may wish to run their slide rule over this rocketing ASX ETF (exchange-traded fund).

There are only a handful of S&P/ASX 200 Index (ASX: XJO) companies involved in the AI revolution. And most of them have been struggling to match the progress made by their larger global competitors. That's also seen many of their share prices take a tumble over the past year.

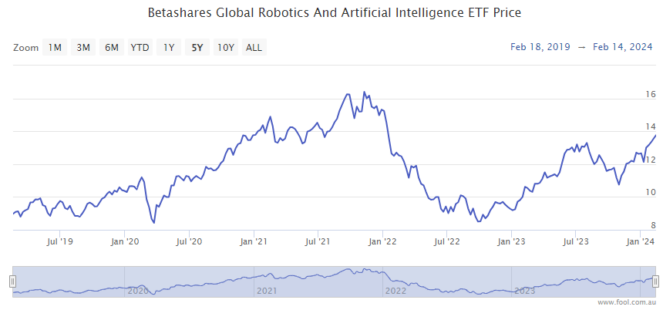

Which is why Betashares Global Robotics And Artificial Intelligence ETF (ASX: RBTZ) has focused its holdings on international stocks developing AI and robotics platforms for tomorrow's world.

ASX ETF capitalising on the AI boom

As you're likely aware, a number of leading global AI stocks have been rocketing amid rapid advancements in generative artificial intelligence.

Like NVIDIA Corporation (NASDAQ: NVDA). Which also happens to be the biggest holding of this ASX ETF.

On the back of its AI advancements, the Nvidia share price has rocketed 230% over 12 months. And shares are up an eye-popping 1,726% over five years. That gives Nvidia a market cap of US$1.79 trillion (AU$2.8 trillion)!

To put that in perspective, that's some $30 billion more than the current valuation of global giant Amazon.com Inc (NASDAQ: AMZN).

Atop Nvidia, RBTZ's other top holdings include Intuitive Surgical Inc, ABB Ltd and Keyence Corp.

The success of its portfolio holdings has helped the ASX ETF's share price surge by 32% in 12 months.

RBTZ also pays an annual unfranked dividend. On 18 July, the fund paid out 63 cents per share. Adding that back in and the accumulated value of the ASX ETF is up more than 40% for the full year.

Annual management fees and costs for the Betashares Global Robotics And Artificial Intelligence ETF come out to 0.57%.

So what about these billionaires and their AI investments?

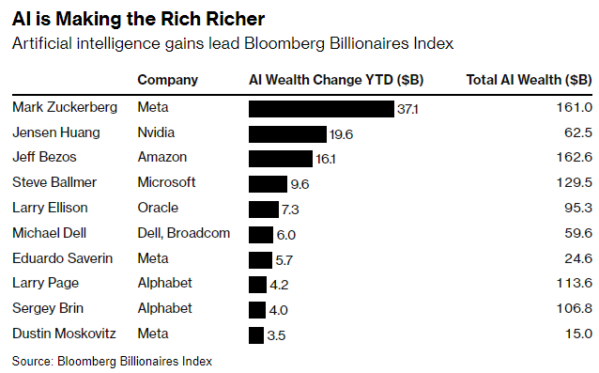

Circling back to the billionaire-making AI revolution this ASX ETF is tapping into, have a look at the chart below (courtesy of Bloomberg).

These billionaires all attribute at least part of their mammoth 2024 wealth gains to investments in companies tracked by the Bloomberg Global Artificial Intelligence Index.

As you can see, Facebook founder – or Meta Platforms Inc (NASDAQ: META), if they insist – Mark Zuckerberg leads the pack. Zuckerberg's wealth has surged by US$37.1 billion so far in 2024!

Then there's Nvidia, the top holding of this artificial intelligence-focused ASX ETF.

Nvidia co-founder Jensen Huang comes in at number two on this billionaires list, seeing his wealth grow by US$19.6 billion year to date.

Boom!