The Magellan Financial Group Ltd (ASX: MFG) share price is climbing 6% after the funds management company reported its FY24 first-half earnings and announced who its new CEO will be.

Magellan shares opened 1% higher, and it's currently up to $9.47.

Magellan share price jumps despite difficult FY half-year result

- Management and service fees revenue down 28% to $130.3 million

- Profit before tax and performance fees of funds management business down 33% to $79.9 million

- Adjusted net profit after tax (NPAT) down 5% to $93.5 million

- Statutory NPAT up 24% to $104.1 million

- Average funds under management (FUM) down 31% to $36.9 million

- Partially franked interim dividend down 37% to 29.4 cents per share

The funds management side of the business suffered from the drop in FUM, but NPAT profitability was supported by a 90% rise in other revenue and income to $52.4 million, driven largely by realised capital gains of $37.8 million.

It also recorded a $22.1 million benefit related to buying Magellan Global Fund (ASX: MGF) options.

What else happened?

Magellan has been led by executive chair Andrew Formica for the last few months following the departure of the former CEO and managing director.

The company has appointed Sophia Rahmani to the 'transitionary role' of managing director of the main operating subsidiary, Magellan Asset Management. Meanwhile, Formica will remain as the executive chair for now.

Magellan's board intends to appoint Rahmani as the CEO of Magellan within 12 months of her commencement, and it is intended for Formica to revert to the non-executive chair of Magellan.

The company said since Formica's appointment as executive chair, Magellan has seen "improved stability within the business and with clients and wider stakeholders". Formica has addressed a number of issues, including the share purchase plan loans for employees.

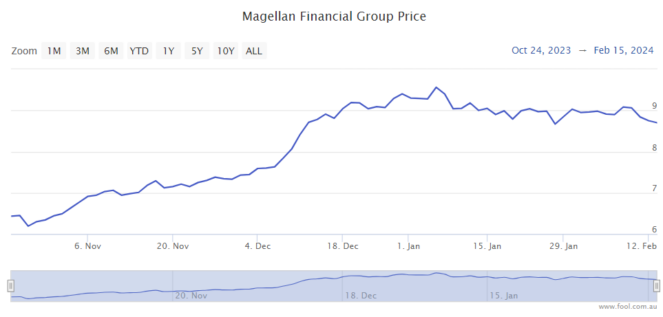

The Magellan share price fell 3% on the day it was announced Formica was going to take an active leadership role, but since then the Magellan share price has gone up by 40%.

What did Magellan management say?

Magellan executive chair Andrew Formica said:

Over 1H24 we have restored corporate stability, resolved a number of legacy issues and are gaining momentum on our strategic priorities.

Most importantly, our investment teams continue to deliver improved investment performance across our strategies, adding value for our clients. I am confident that this will lead to continued improvement in our net flows, which have seen signs of stabilisation in recent quarters.

Whilst more needs to be done, we remain a highly profitable business, with robust operating cashflows and significant financial strength in the form of our strong balance sheet. I am encouraged by the progress we are making and am confident our strong foundations position us well to deliver positive outcomes for our clients and shareholders.

What's next for Magellan?

The company said the enhanced and refocused US distribution platform is expected to be a key growth avenue for the business.

Magellan is planning to launch the Magellan Unconstrained Fund to its retail client base. This fund has outperformed over the past six months, year, two years and since inception.

It's also looking at asset classes that can leverage its distribution and operational platform.

An AI working group has been established to identify opportunities to incorporate the technology across the business.

FY24 full-year costs are expected to be between $97.5 million to $102.5 million for the funds management business, with costs in FY25 expected to be broadly in line with FY24.

Magellan share price snapshot

After today's recovery, the Magellan share price is now largely unchanged compared to the start of the year.