The Temple & Webster Group Ltd (ASX: TPW) share price is running hot today.

Again.

Shares in the online furniture and homewares retailer closed yesterday trading for $10.02. In early morning trade on Tuesday, shares are swapping hands for $10.65 up 6.3%.

For some context, the All Ordinaries Index (ASX: XAO) is up 0.1% at this same time.

This comes following the release of the company's half-year results for the six months ending 31 December (H1 FY 2024).

Here are the highlights.

Temple & Webster share price leaps amid surging revenues

- Record half-year revenue of $254 million, up 23% year on year

- Earnings before interest, taxes, depreciation and amortisation (EBITDA) increased 3% from H1 FY 2023 to $7.5 million

- The EBITDA margin of 2.9% came in at the top end of full-year guidance of 1% to 3%

- Closing cash balance of $114 million and no debt as at 31 December

What else happened during the half year?

The company noted that the all-time high half-year revenue it achieved was driven by growth in both repeat and first-time customers. Second quarter revenue was up 40%, with management crediting a strong Black Friday-Cyber Monday sales period.

The Temple & Webster share price also looks to be getting a boost with that momentum carrying into the second half of the financial year. From 1 January through to 11 February trading was up 35% year on year.

In August, Temple & Webster outlined a strategy to target annual sales of at least $1 billion within three to five years.

The six-month period saw the online retailer's private label division launch 500 new products spanning all of its key categories.

And after eight years as chief financial officer, Mark Tayler announced that he will be stepping down as CFO.

What did management say?

Commenting on the record half-year revenue sending the Temple & Webster share price leaping higher today, CEO Mark Coulter noted, "This was in the face of some of the toughest headwinds to our category we have ever seen due to the current economic conditions."

Coulter added:

Pleasingly, our growth was driven by both first-time customers and repeat customers, which led to us crossing the 1 million Active Customer mark in February this year. This means that our amazing range, great value proposition and incredible service has resonated with 1 million Australians in the last 12 months…

Our goal is to achieve scale as quickly as possible while remaining profitable, and our EBITDA result of $7.5 million for the first half of the year, even after costs associated with the above-the-line brand investment, gives us confidence to invest in growth to take further market share. The online market remains under-penetrated in Australia.

What's next for Temple & Webster?

Looking at what may impact the Temple & Webster share price in the months ahead, the company cited its strong balance sheet strengthened "even after the additional brand investment and the buyback program".

Management said this opens the door to potentially pursue new opportunities, support its growth plans and "fund sensible capital management initiatives such as our ongoing share buy-back program".

The company reaffirmed its full FY 2024 EBITDA margin guidance of 1% to 3%.

Temple & Webster share price snapshot

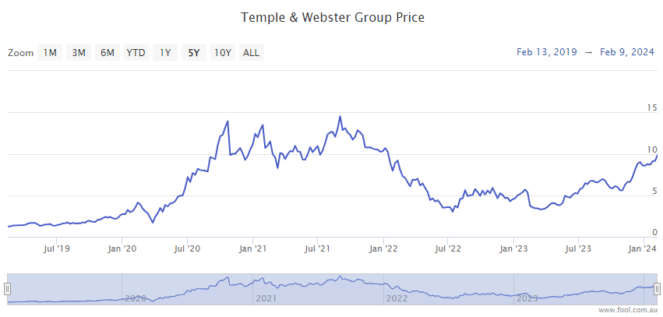

With today's intraday lift factored in, the Temple & Webster share price is up a whopping 115% over the past 12 months.