There are a lot of ASX-listed exchange-traded funds (ETFs) that investors can choose from. iShares Global 100 ETF (ASX: IOO) is one way to gain diversification and own global winners.

I think Aussies need a certain amount of international exposure in their portfolios. The Australian share market is great, but there are a lot of other great businesses out there.

Some ASX ETFs provide enormous diversification, owning more than 1000 holdings. We don't necessarily need to own a huge amount — just enough for good diversification but not to reduce the potential return performance.

100 leaders

The iShares Global 100 ETF invests in 100 of the biggest companies in the world. I think 100 businesses is a good number for strong diversification.

We're talking about businesses like Microsoft, Apple, Nvidia, Amazon.com, Alphabet, Eli Lilly, Mastercard, ASML, Samsung, Toyota, Walmart, LVMH, Caterpillar, BHP Group Ltd (ASX: BHP), HSBC, Siemens and Unilever.

Many are the best in the world, or among the best, at what they do.

Pleasingly, the ETF's biggest allocation is to the IT sector, which I think has the strongest potential for returns due to margins and no physical limitations to software.

Geographic diversification

It's good to see some geographic spread of holdings beyond the United States in the iShares Global 100. Countries with a weighting of more than 2% include the United Kingdom, Switzerland, France, Japan and Germany.

Of course, there's more to it than just where the business is listed. The underlying companies within this ASX ETF don't just generate revenue in one country, such as the US. They make money globally, which means they offer global earnings diversification.

For example, Apple and Microsoft are company giants that generate revenue in almost every country.

Strong returns

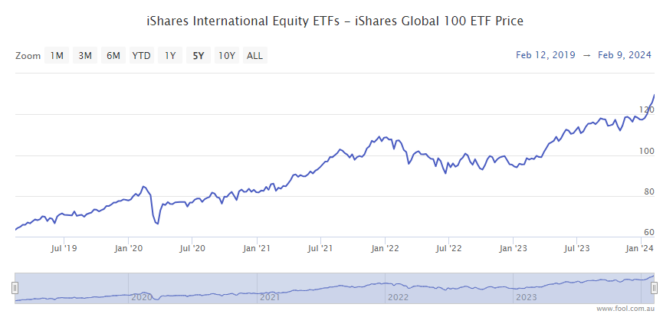

The iShares Global 100 ETF has performed very strongly over the longer term, though past performance is no guarantee of future returns.

The IOO ETF has returned an average of 16.7% per annum over the past five years, which is a very pleasing rate of wealth-building.

The names within the portfolio are likely to keep changing over time, but as a group, I think they can keep doing well. These are the biggest businesses in the world making the biggest profits. I believe can keep making returns from their economic moats and large scale.

Ultimately, investing is about making returns, and this is a good option, in my opinion.