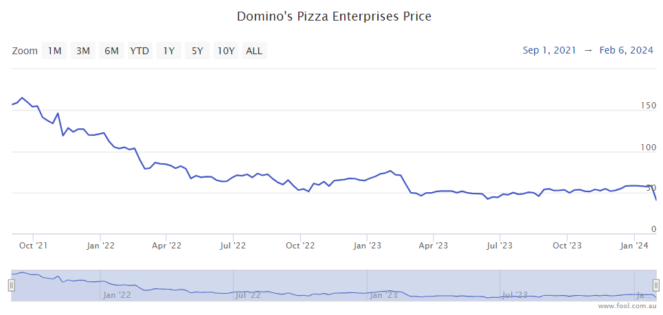

Domino's Pizza Enterprises Ltd (ASX: DMP) stock has been through a terrible plunge, it is currently 30% lower than its level on 15 January 2024.

The sell-off was sparked by a trading update. You can read the coverage of that from my colleague James Mickleboro here.

While the company saw good sales growth in ANZ and Germany, it suffered from negative same-store sales performance in Japan, Taiwan, Malaysia and France.

In the FY24 first half, Domino's is expecting to report net profit before tax (NPBT) of between $87 million to $90 million, which is lower than what it generated in the FY23 first half, and above the FY23 second half.

Management said improvements are required in the FY24 second half to grow order volumes and it withdrew its guidance and commentary about its FY24 performance.

Is this a big worry for Domino's stock?

The market usually judges a profitable business on how much profit it's making and the direction of the profit. Clearly, investors were not impressed.

But, one of the leadership figures of Domino's – chair Jack Cowin – is not concerned by the fall of around 75% of the Domino's share price since 2021 which has seen his current shareholding fall in value by roughly $2.8 billion – it's now 'only' worth around $950 million.

The Australian Financial Review reported that Cowin said:

If you're not buying or selling it doesn't matter. The last couple of years the ball hasn't bounced the right way.

The board is supportive of the direction the company is taking. The company is supportive of Don.

Cowin noted pain in Malaysia for American-related fast food brands because of a boycott relating to the Gaza war, with Malaysia reportedly supporting Palestine.

The Domino's chair said the company is working on reinventing overseas markets where a disappointing performance could eventually be turned around.

What now?

It could take Domino's stock a bit of time to regain investor confidence – this is not the first time that the Domino's share price has sold off.

If the business can regain momentum in some of these underperforming markets, particularly Japan and France, then it could send the profit and perhaps the share price back in the right direction.

The estimates on Commsec currently suggest the business could achieve a similar earnings per share (EPS) and pay a similar dividend in FY24 as FY23. EPS could be $1.44 and the dividend per share could be $1.10, which would put the business at 29 times FY24's estimated earnings and a dividend yield of 2.7%, excluding any possible franking credits.