Owners of Rio Tinto Ltd (ASX: RIO) shares have been getting juicy dividends for a number of years, thanks to the huge demand for commodities from China.

Its biggest earnings contributor is iron ore, but it also deals with a number of other commodities such as copper, aluminium and a few more.

How big could the Rio Tinto dividends be in 2024 and beyond?

There could be another big annual dividend from the company in 2024, thanks to the strength of the iron ore price.

At the moment, the forecast on Commsec suggests Rio Tinto could pay an annual dividend per share of $7.60. That's a cash dividend yield of 5.75%, or 8.2% when grossed up.

According to Trading Economics, the iron ore price is sitting at around US$130 per tonne, which is a good price for the ASX mining share to make plenty of profit.

Trading Economics noted there had been further economic support from the Chinese government, with the People's Bank of China saying that it would reduce its reserve requirement ratio, "adding liquidity to the financial system and supporting manufacturing and construction activity".

The strong iron ore price comes despite new home prices in China reportedly dropping in December at the fastest pace since 2015.

Trading Economics also said that the iron ore price was supported by hot rolled coil and stainless steel inventories at major Chinese warehouses edging lower in the third week of January, which pointed to "some bidding activity for ferrous metals."

The iron ore price is hard to predict a few months into the future, let alone years ahead. But, analysts have given it a shot at forecasting what the dividends might be.

On Commsec, the forecast is that Rio Tinto could pay an annual dividend per share of $7.36 in 2024. This would translate into a cash yield of 5.6% and a grossed-up dividend yield of 8%.

Is now a good time to invest?

Rio Tinto is one of the world's leading miners. As such, it's very good at what it does. I like the diversification that it offers with different commodities.

I'm particularly excited by the company's moves to gain exposure to copper, which is an important commodity for the decarbonisation and electrification of the world.

I also like the company's planned expansion into African iron ore mining with its involvement in the Simandou project.

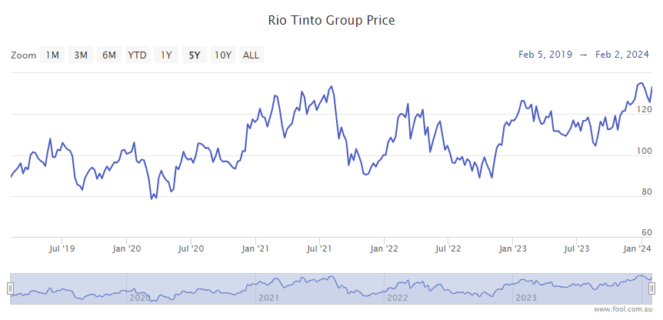

There's a lot to like about the future. However, I'm cautious about investing in Rio Tinto shares right now because of the strength of both the iron ore price and the Rio Tinto share price.

To beat the market over the long-term, I'd prefer to invest when the sentiment about iron ore is weak and the iron ore price is much closer to US$100 per tonne, if not below. So, I'd be patient on the ASX mining share, for now.