The Origin Energy Ltd (ASX: ORG) share price charged full steam ahead on Wednesday following the company's December quarterly report.

As Australia Securities Exchange (ASX) trading closed for the day, shares in the $14 billion utility giant were up 2.7% from their previous closing price, settling at $8.52 apiece. The decent gain put Origin's performance above that of other utility companies included in the S&P/ASX 200 Index (ASX: XJO).

Let's take a closer look at what sparked the rally today.

Origin share price lifts on a mixed quarter

The headline numbers for all investors to know from today's release include:

- APLNG production up 1% to 167.4 petajoules (PJ) versus the prior corresponding period

- APLNG gas sales down 1% to 160.4 PJ versus the prior corresponding period

- Commodity revenue down 25% to $2.38 billion

- Electricity sales up 6% to 9.0 terawatt hours (TWh)

- Natural gas sales down 5% to 46.2 PJ

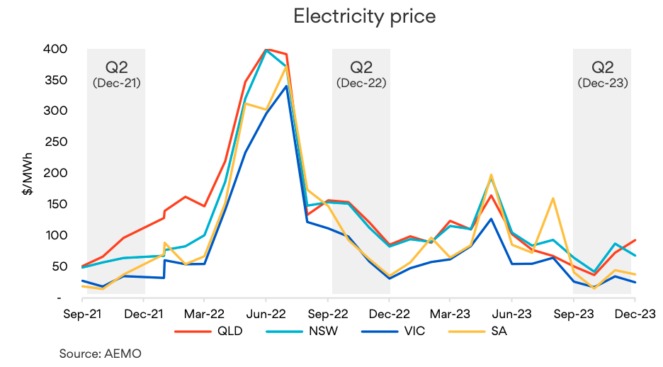

Based on the numbers, the December quarter appeared favourable for electricity and weaker for gas.

According to the report, lower gas production was experienced quarter-on-quarter due to an unplanned power outage on an LNG vessel. The interruption at Origin's Curtis Island facility left the company incapable of loading three LNG carriers.

Adding to the pain, the average realised LNG price plunged 25% to US$11.88 per million British thermal units (MMBtu). However, the price was a 2% improvement from the September quarter figure.

The weakness in gas resulted in a reduction of Origin's cash share from Australia Pacific LNG for the six months ended 31 December 2023. Falling 17% from its previous financial year-to-date amount, Origin received $648 million from the gas business.

Conversely, electricity sales increased 6% — as shown above — due to warmer weather and more customers.

What did management say?

Origin Energy CEO Frank Calabria shined a light on the company's continued push into renewables during the quarter, stating:

We achieved further progress on our strategy to grow renewables and storage in our portfolio with the approval of a $400 million investment to construct a large-scale battery at Mortlake Power Station.

We also made a further investment in Octopus Energy to lift our interest as the company continues to grow rapidly and expand the global licensing of its Kraken platform.

On 18 December 2023, Origin upped its stake in Octopus Energy from 3% to 23%. The increased holding in the UK technology and energy company required $530 million.

Origin Energy share price snapshot

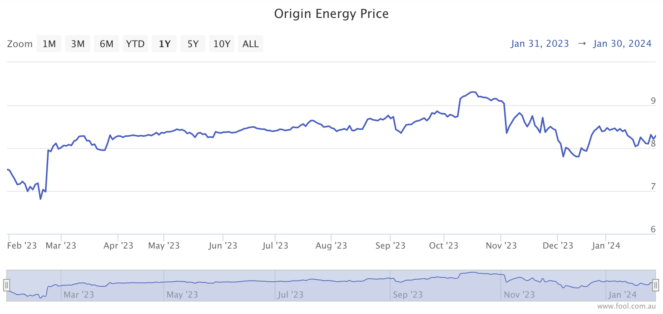

Even though the $20 billion takeover by Brookfield and EIG fell through late last year, Origin shares have held onto most of their accumulated gains.

As depicted below, the Origin share price is 15% higher than where it was seated 12 months earlier.

Still, shareholders may feel slighted by the fact Origin's market capitalisation is a distance from the collapsed bid of $20 billion. The company is currently valued at $14.68 billion, which puts Origin 36% away from Brookfield's offer.