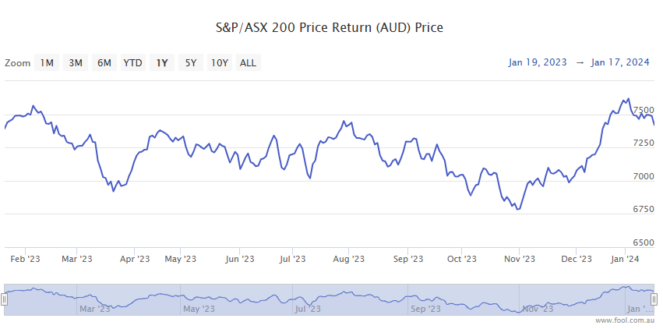

The S&P/ASX 200 Index (ASX: XJO) is under selling pressure on Thursday.

In early afternoon trade, Australia's benchmark index is down 0.7%.

But today's fall has very little to do with any specific issues among ASX 200 companies.

Rather the Aussie market is facing some broader macroeconomic headwinds from two fronts.

Here's what's going on.

ASX 200 hit from two fronts

The first macro headwind that's giving Aussie investors the jitters and sending the ASX 200 lower is blowing out of China.

This comes as analysts forecast weaker growth ahead in 2024 for the world's number two economy and Australia's top export market.

China's economy grew by 5.2% in 2023, meeting expectations. But growth is widely forecast to fall below 5% in 2024 as the nation continues to struggle with high debts and a floundering real estate market. China's shrinking population, while potentially a good thing over the longer term, is also pressuring the growth outlook for the economy.

With China's crude steel output figures for December down 15% year on year and the lowest level in seven years, iron ore prices may also keep coming down. Overnight the industrial metal slipped 2.7% to US$125.80 per tonne.

Commenting on the shaky outlook for China's economy that looks to be pressuring the ASX 200 today, Capital Economics head of China economics Julian Evans-Pritchard said (quoted by The Australian Financial Review), "The recovery clearly remains shaky. And while we still anticipate some near-term boost from policy easing, this is unlikely to prevent a renewed slowdown later this year."

Which brings us to…

Global interest rates

Hopes of a March interest rate cut from the US Federal Reserve continue to recede. And as we've seen over the past year, the ASX 200 has proven quite susceptible to expectations on US interest rates.

Traders further reduced bets of a March rate cut from the world's most influential central bank after Federal Reserve governor Christopher Waller signalled that the Fed was unlikely to rush into the easing cycle.

Yesterday (overnight Aussie time), Waller said (quoted by Bloomberg), "When the time is right to begin lowering rates, I believe it can and should be lowered methodically and carefully."

But he spooked investors, and likely added to selling action on the ASX 200 today, by adding, "With economic activity and labour markets in good shape and inflation coming down gradually to 2%, I see no reason to move as quickly or cut as rapidly as in the past."

Commenting on the outlook for rate cuts, Krishna Guha, vice chairman of Evercore ISI said (quoted by the AFR), "What we think some in the markets have been missing – or not putting enough weight on – is the central banks' shared fear of starting too soon and having to stop or reverse course."

And it's not just the US that could see rates stay higher for longer.

With inflation ticking higher in the United Kingdom for the first time in 10 months, it's unlikely the Bank of England will be cutting rates in the near term either.

According to Ed Monk, associate director at Fidelity International:

The rise in inflation today suggests that the market has got ahead of itself in expecting early rate reductions. Today's reading is a setback. The last portion of above-target inflation may prove the most difficult to shift.

But higher rates for longer doesn't mean there aren't plenty of good investment opportunities on the ASX 200. And with the benchmark down 3.7% year to date, some of these big companies are likely selling for a bargain.