Four small ASX shares are giving investors a very happy start to 2024.

At Monday's close, less than five trading days into the New Year, all of these ASX shares had already gained more than 20% since the opening bell on 2 January.

To put that in some context, the All Ordinaries Index (ASX: XAO) is down 1.95% over that same period.

Though take note, most of these companies are quite small, and investing in microcap stocks comes with added risks, including significant volatility.

So, which ASX shares are shooting the lights out?

I'm glad you asked!

Four ASX shares rocketing higher in the New Year

Starting with the 'laggard', we have 3D geospatial data technology company Pointerra Ltd (ASX: 3DP).

The Pointerra share price is up 22.73% so far in 2024, closing yesterday trading for 5.4 cents per share.

There have been no price-sensitive releases from this ASX share since the company's quarterly update on 31 October. But it's worth noting that even with this year's big boost, the Pointerra share price is still down 71.58% over 12 months.

So perhaps we're seeing some bargain hunting here.

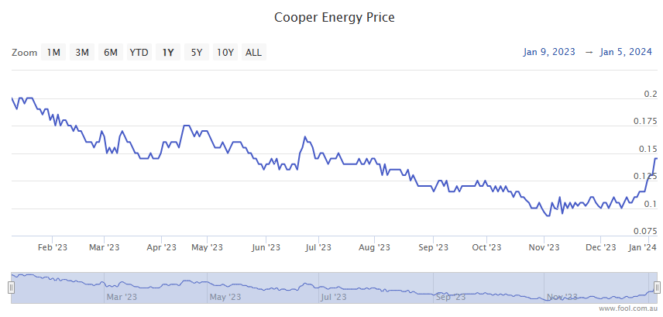

Next up, we have Cooper Energy Ltd (ASX: COE).

The ASX All Ords energy stock is up 23.08% in 2024, with shares swapping hands for 16 cents apiece at Monday's close.

Investor enthusiasm for the ASX share looks to have gotten a lift on Friday when the company reported strong results from its Orbost gas processing plant improvement project.

Cooper Energy said that the production rate at its plant reached record levels of 67.3 terajoules per day (TJ/d). Management also said there were numerous occasions over the past two weeks where instantaneous rates exceeded the plant's nameplate capacity of 68 TJ/d.

The Cooper Energy share price closed up 10.3% on the day.

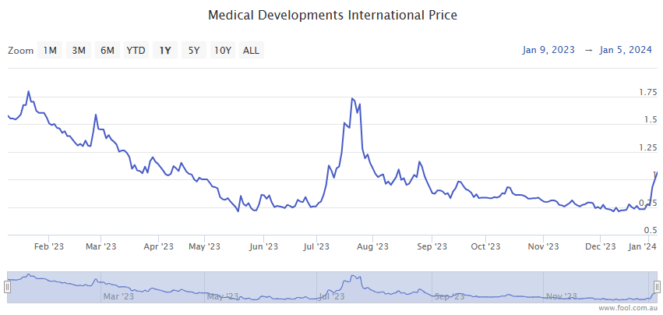

Which brings us to ASX healthcare stock Medical Developments International Ltd (ASX: MVP).

The Medical Developments share price is up 32.24% in 2024, with shares closing yesterday trading for $1.05 apiece.

As with Pointerra, it's been a long time since this ASX share released any price-sensitive announcements. In this case, all the way back on 31 August when the company released its full-year financial results.

But with the Medical Developments share price having sunk 49% in 2023, investors may also be looking for potential bargains here.

Rounding out the list, up 19.35% gain so far in 2024, is telehealth company Doctor Care Anywhere Group PLC (ASX: DOC), closing Monday trading for 7.4 cents per share.

That sees this microcap ASX share up 42.31% over the past 12 months.

Investor enthusiasm looks to have gotten a boost on Thursday following the company's extraordinary general meeting (EGM).

This saw management announce the refinancing of its debt obligations. They noted the refinancing "frees up the company's resources to be invested in the operations and growth of the business".

The ASX share closed up 15.2% on Thursday and gained another 10.5% on Friday.