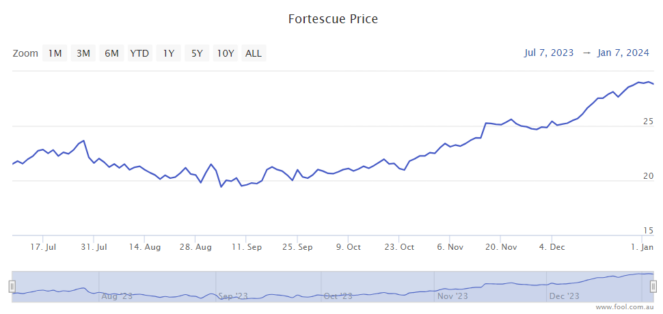

The Fortescue Ltd (ASX: FMG) share price has done well in recent months, up 30% in the past six months. The ASX mining share has soundly beaten the S&P/ASX 200 Index (ASX: XJO), which is 6% higher over the same time period.

Of course, a key part of that success has been the strong performance of the iron ore price.

Big rally of the iron ore price

Commodity business profits can dramatically change when the commodity price changes.

It costs Fortescue roughly the same amount per tonne each month to produce the iron ore it does. Any extra revenue it receives for production when the iron ore price goes up largely turns straight into extra profit, aside from paying more to the government.

According to Trading Economics, the iron ore price has lifted from below US$120 per tonne to US$145 per tonne in three months. That's a big rise in a fairly short time.

Trading Economics explained what's likely behind this price rally:

The Chinese government continued to implement measures to stimulate property and infrastructure development, lastly exemplified by the PBoC lending CNY 350 billion to other policy banks, including the China Construction Bank.

The developments magnified strong buying from steel mills as they aim to restock in the winter, compounding on robust demand from producers at the turn of the year as Beijing suspended output controls to improve margins for the debt-ridden property developers.

Trading Economics' global macro models and analyst expectations estimate that the iron ore price will be at US$155 per tonne in 12 months.

Is this a good time to invest in Fortescue shares?

I like the progress the business is making with its green energy efforts. The green hydrogen and green ammonia projects are getting closer, though they still aren't actually making much money here. The battery division is producing a decent amount of revenue, but it's very small compared to the scale of Fortescue's iron ore operations.

I'd suggest readers should take a cyclical approach when investing in Fortescue shares and other iron ore miners. I think we should invest when the iron ore price is weak, not when it's strong.

Fortescue could pay big dividends during this period of higher iron ore prices, but there's a danger of overpaying.

I think a good time to invest is when there's a bearish outlook for the iron ore price. In the past, I've used the iron ore price below US$100 per tonne as a good time to think about Fortescue.

The Fortescue share price is very elevated, noticeably above where it was in 2021 when the iron ore price was above US$200 per tonne.

I'm not buying Fortescue shares right now. In fact, I have considered taking some profit off the table, though I haven't (yet). It's possible that the iron ore price could keep rising. If I continue to hold, I assume I'll receive good returns through the dividends.