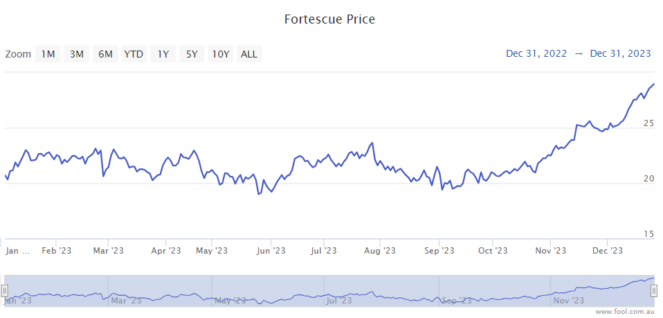

The Fortescue Ltd (ASX: FMG) share price jumped 42% in 2023, making it an incredible year for the ASX mining share.

Fortescue has had a growing focus on green energy. But since the company began, iron ore mining has been the key to its earnings potential. So let's look at what happened.

Iron ore strength

The end of 2023 is just a snapshot of the Fortescue share price of what's been going on through the current period of time.

If the year had finished at the end of September 2023, the Fortescue share price would have barely registered any gain at all from the start of 2023.

But, pleasingly for Fortescue shareholders, the iron ore price soared in the last three months of the year, rising by around US$20 per tonne to roughly US$140 per tonne, according to Trading Economics. The iron ore price saw roughly the same increase over the whole year as well.

Trading Economics suggests there is robust demand for industrial metals, supported by "repeated measures of economic support from the Chinese government… headlined by the decision to suspend the country's annual steel production cap in August, which consequently lifted demand for key iron ore inputs."

That change in China "set the precedent for multiple stimulus injections and monetary easing policies from the PBoC, aligning with Beijing's pledges to stimulate infrastructure development and manufacturing activity in 2024", according to Trading Economics.

Why does it matter so much?

Mining costs don't usually change each month, so extra revenue is largely just a boost straight onto the net profit line of the financials, aside from paying more to the government.

With the iron ore price now at US$140 per tonne, it meant the company was entering 2024 with strong profit generation potential and that could mean bigger dividends, helping Fortescue shares.

Green energy progress

Fortescue is putting major work into decarbonisation and creating its own production of green hydrogen (and green ammonia). It's also building an expansive high-performance, industrial battery division.

While it's still some time away from the company making green hydrogen at an industrial scale, each year that goes by brings that green energy reality closer.

In the three months to September 2023, the latest quarterly update, it said it continued to progress its global portfolio of green energy projects, with a target of taking five final investment decisions by the end of the 2023 calendar year.

Time will tell how many it ended up approving – we'll probably hear about that in the update for the three months to December 2023, which may be announced near the end of January 2024.

Iron ore will probably remain the biggest profit generator for many years to come, but at some point down the line, the green energy division could make sizeable earnings, which would then have an important influence on Fortescue shares.