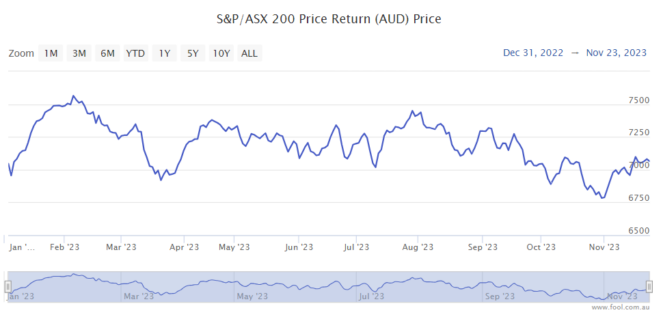

The ASX share market has had a bit of a volatile 2023. Just look at the chart below of the S&P/ASX 200 Index (ASX: XJO). Through all of those ups and downs, the ASX 200 is almost exactly where it started in 2023. Hence, could there be a bear market or stock market crash in 2024?

How likely is a bear market?

It's certainly possible that a crash might happen. Part of the equation will be what level the ASX 200 actually starts the year at. If it started at 7,000 points and dropped to 6,300 points that'd be a fall of 10%. If it starts 2024 at 6,500 points and drops to 6,300 points then that'd only be a fall of 3%.

The ASX share market does sometimes seem a painful fall. We've seen hefty declines during both 2020 and 2022.

Interest rates have thrown a lot of uncertainty in the air. It's possible that interest rates could go higher next year if central banks, particularly the RBA, aren't happy that inflation is being brought under control in an acceptable timeframe.

Some investors may be thinking that the next move by central banks may be a reduction, so another hike could be quite (negatively) surprising. Though, that wouldn't necessarily cause a stock market crash.

Why do interest rates matter? Warren Buffett once said:

The value of every business, the value of a farm, the value of an apartment house, the value of any economic asset, is 100% sensitive to interest rates because all you are doing in investing is transferring some money to somebody now in exchange for what you expect the stream of money to be, to come in over a period of time, and the higher interest rates are the less that present value is going to be. So every business by its nature…its intrinsic valuation is 100% sensitive to interest rates.

It's impossible to know what's going to happen without a crystal ball. But, it seems to me that the market is acting optimistically about the economic situation, even though the full effects of interest rates are yet to flow through economies like the US and Australia.

I wouldn't be surprised if some individual businesses see declines on disappointing updates, but I'm less certain that a bear market/market crash will happen across the board because employment rates in the US and Australia remain stronger than expected 12 months ago. That's promising for bank arrears, retail spending and so on.

Expert view on a stock market crash

Morgan Stanley recently said that it's expecting there to be a "decrease in valuation" early in the year. While those comments were focused on US shares, the ASX stock market often follows the movement of US shares, particularly in the shorter term. Morgan Stanley wrote:

For the first half of 2024, strategists recommend that investors stay patient and be selective. Risks to global growth—driven by monetary policy—remain high, and earnings headwinds may persist into early 2024 before a recovery takes hold. Global stocks typically begin to sell off in the three months leading into a new round of monetary easing, as risk assets start pricing in slower growth. If central banks stay on track to begin cutting rates in June, global equities may see a decrease in valuation early in the year.

But, in the second half, the investment bank thinks falling inflation will lead to interest rates being reduced, helping growth.

However, in a worry for ASX 200 shares and adding to the danger of a stock market crash, Morgan Stanley warned:

Emerging-markets equities face obstacles, including a strengthening dollar and lacklustre growth in China, where policymakers face the triple challenges of debt, demographics and deflation. These risks are compounded by the corporate focus on diversifying supply chains amid geopolitical tensions and the fallout from pandemic-era disruptions.