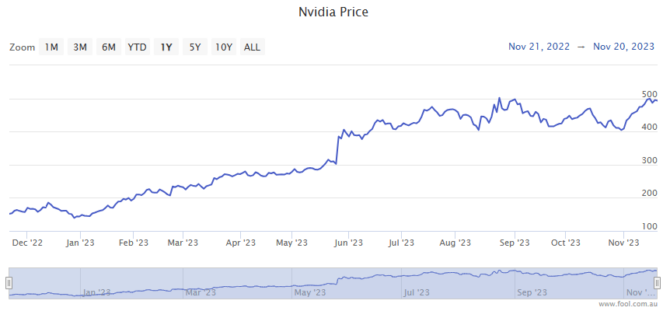

The Nvidia Corporation (NASDAQ: NVDA) share price is the gift that keeps on giving.

Or at least it has been so far in 2023.

Yesterday (overnight Aussie time), shares in the US generative artificial intelligence company closed up another 2.3%, finishing the day at $504.20.

That puts the Nvidia share price up a whopping 252% since the opening bell on 3 January. And it gives the tech stock an eye-popping market cap of US$1.25 trillion (AU$1.92 billion)

What's been driving investor interest in the US tech stock?

The Nvidia share price has been going gangbusters this year on the back of its leading AI tech platforms, spurred by soaring global interest ChatGPT-like tools.

And the company managed to surprise on the upside with both its first and second-quarter earnings results. Nvidia reported first-quarter revenue of US$7.19 billion, about 10% above consensus expectations. And second-quarter revenue soared to US$13.51 billion, exceeding analyst estimates by 22%.

Nvidia CEO Jensen Huang noted on the day of its Q2 results:

A trillion dollars of installed global data centre infrastructure will transition from general purpose to accelerated computing as companies race to apply generative AI into every product, service and business process.

What next for the Nvidia share price?

By this time tomorrow, we'll know exactly how Nvidia performed in the third quarter. The tech company reports its results on Tuesday in the US, overnight here in Australia.

Investors look to be hedging their bets at the moment, with the Nvidia share price up 0.1% in after-hours trading.

Expectations remain high for the company amid ongoing enthusiasm around generative AI. But it could be set to smash those expectations once again.

According to Bloomberg Intelligence, Nvidia's quarterly sales could exceed consensus forecasts "with a 170% surge amid sustained generative AI demand for accelerators".

Bloomberg Intelligence notes:

The firm's ability to quickly produce chips for China that also comply with export controls imposed by US regulators should help mute the impact of these restrictions on its earnings.

Citi added, "Investors will pay particular attention to how the US curbs on AI chip exports to China will affect Nvidia's data centre business."

Indeed, Nvidia's 'Data Center' segment was the main contributor to its record second-quarter revenue.

If the company can again surprise to the upside, the Nvidia share price could well be hitting new records once more.