One fund manager has singled out the S&P/ASX 200 Index (ASX: XJO) share Nufarm Ltd (ASX: NUF) as an investing opportunity.

L1 Capital has given a vote of confidence in the ASX agriculture share, particularly at its current share price.

For investors who aren't familiar with the company, Nufarm describes itself as a global crop protection and seed technology specialist. Nufarm was reportedly the first operation to develop and commercialise planted-based Omega-3 and has also developed and commercialised advanced bioenergy feedstock technology.

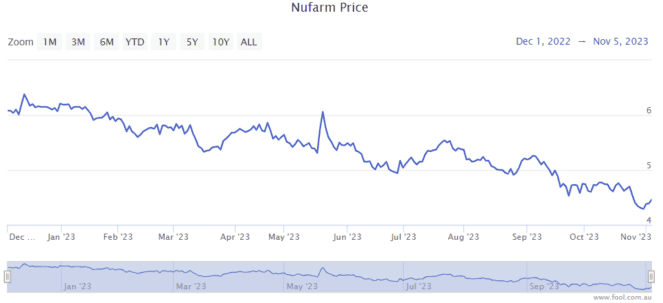

As we can see on the chart below, the Nufarm share price is down by around 30% since its 52-week high in December 2022.

Why does L1 like the ASX 200 share?

The fund manager explained Nufarm's recent trading was impacted by weaker US rainfall and "transitory farmer de-stocking impacts".

L1 said the "world's leading Omega-3 seed technology" has the potential to deliver a "step change" in Nufarm's earnings in FY25 or FY26. It pointed out the long-term growth aspiration of the company is to grow earnings before interest, tax, depreciation and amortisation (EBITDA) from $59 million in FY22 to $146 million in FY26.

The L1 investment team says there is a huge pipeline of crop protection product launches.

It also likes the valuation the Nufarm share price is trading at, which I'll get to in a moment.

FY23 outlook

Just over a month ago, the ASX 200 share updated its outlook for the 2023 financial year, which was for the 12 months ending 30 September 2023.

In FY23, it expects to report underlying EBITDA in the range of between $430 million to $440 million. Its leverage ratio is expected to be between 2.1 to 2.4 times. Inventory has reduced during the period, though this was "more than offset by an increase in receivables due to the phasing of sales".

Nufarm CEO Greg Hunt said:

We expect to deliver another good result for FY23, following on from the record earnings result delivered in FY22. Despite a very challenging operating environment, we have seen the benefits of revenue diversification across the group, with some softness in crop protection offset by a very strong performance in seed technologies.

We remain on track for our FY26 revenue aspirations.

Nufarm share price valuation

According to L1, the ASX 200 share is trading at roughly 12 times FY24's estimated earnings and on average is delivering earnings per share (EPS) growth of 15% per annum.

In other words, the EPS growth rate is higher than the company's price/earnings (P/E) ratio. When the price-to-earnings-growth (PEG) ratio is less than one, that's seen as an attractive opportunity.